Ampleforth is a young but very revolutionary project defined as a smart-commodity money. The idea behind its infrastructure is to change the total supply of a token according to its price fluctuations until achieving an equilibrium.

This feature gives it unique properties in a crypto market where all tokens behave similarly, follow the same trends, and —at least financially— have similar characteristics.

A Brand New Approach That Will Make You Rethink Crypto Trading

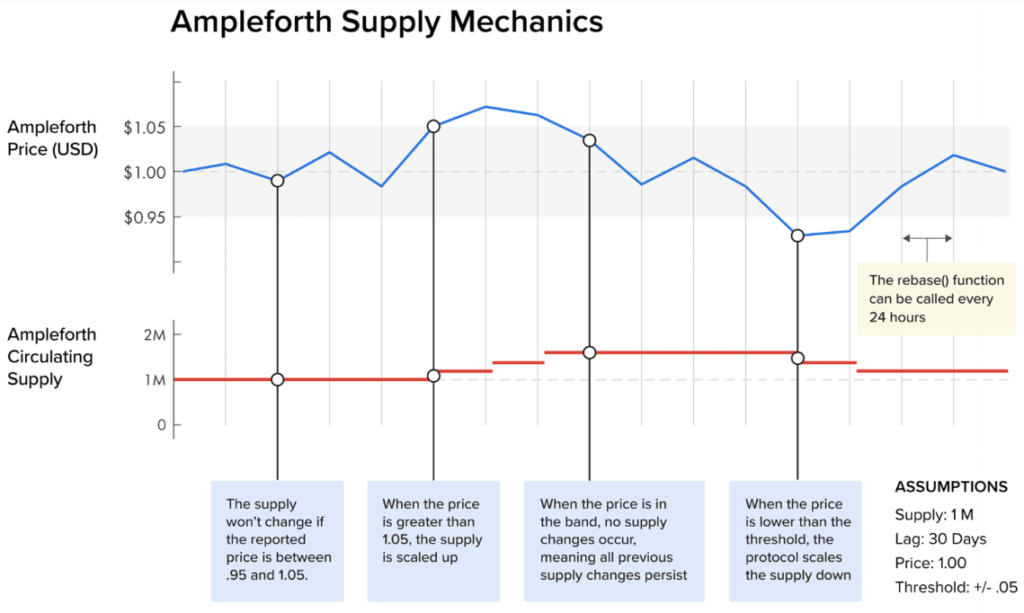

Ampleforth applies “countercyclical pressures” to grant or take away tokens depending on the price variations. This “rebase” takes place every 24 hours, forcing traders to rethink their strategy, “using supply in addition to price as a proxy for gains and losses.” (instead of usually decide their plans mostly based on prices and, sometimes ,trading volume)

Ampleforth Supply Mechanics | Courtesy: Smith and Crown

Ampleforth: A New Protocol That Could Revolutionize DeFi

The fact that it is not correlated with Bitcoin makes it quite interesting for institutional investors and Defi as it is an excellent tool for risk diversification. In fact, Ampleforth has already gained strong acceptance from projects such as Bitfinex, Uniswap, Bancor, and Compound.Finance.

In the case of Bitfinex, the exchange recently announced that of all the possible options, Ampleforth was one of the four tokens that will be used as collateral for margin trading —this token was also Bitfinex’s first IEO. Also, Compound.Finance, a decentralized lending platform recently partnered with Ampleforth to use Ample as collateral. This platform is quite famous for its attractive passive interest system and for being completely decentralized and supported by smart contracts running on the Ethereum Blockchain.

Although Ampleforth is popular among essential players within the ecosystem; it is important to point out that it can also bring in foreign investors unfamiliar with the world of cryptocurrencies.

Imagine that in the market, all metals and commodities moved to the rhythm of gold, with minimal variations. It would not be exciting —or practical— to invest in silver, oil, or any other asset. An investment with a different pattern could revolutionize the financial world because it gives investors the security of being able to compensate losses and manage the risk of their investments with assets that do not “depend” on others.

Ampleforth is backed by Pantera Capital, Brian Armstrong (Coinbase), Arrington Capital, Spartan Group and Huobi Capital, among others. Its revolutionary approach, accompanied by a highly-skilled group – including talents from Google, Uber, and others – made their choice easy.

Despite the recent wave of success, the Ampleforth team is not resting. Recently, the Ampleforth team told Ethereum World News that the firm’s CBO is in China right now, securing important relationships and partnerships that will help them gain a more significant presence in the Asian ecosystem.

A New Way to Lend And Borrow

When Ampleforth’s AMPLs are incorporated into DeFi platforms, like Compound,, Ampleforth can change the way we lend and borrow. Currently, there are not many reasons to borrow assets, but AMPL changes that. With Ampleforth as an input a person could borrow tokens intelligently, and if the supply rebases are positive, the borrower will receive additional AMPL tokens worth market price. After receiving additional tokens, the borrower could simply return the borrowed tokens and fees, and keep the additional AMPL that they received during the positive rebases. Rebases occur everyday at 8pm UTC, and can be positive or negative depending on the 24 hr VWAP (volume-weighted average price) of AMPL.

Furthermore, the borrowing process is easier than with other assets you could borrow in DeFi. It is important to note that Ampleforth makes it easier to go through this process without the friction and fees associated with current methods, just by taking advantage of the rebase function: Instead of borrowing a stablecoin, depositing it on the exchange, buying some other token, trading it, converting it to fiat and repaying the borrowed stablecoin —every single step has its own fees and gas costs— a person could just borrow Amples, wait for the rebase to go up, repay the Amples borrowed and take the profit from the rebase. This also helps reduce the risk of timing. When borrowing AMPL, there is no time lost and no delay caused by waiting for funds to process when removing them from a centralized exchange.

There is nothing written in stone in the world of cryptocurrencies. However, it is possible to see that this Project has many reasons to grow. It may be complicated to understand, but it is undoubtedly worth keeping an eye on it and give it a shot if you want to diversify risks, and if you want to see the newest instrument in the DeFi space.