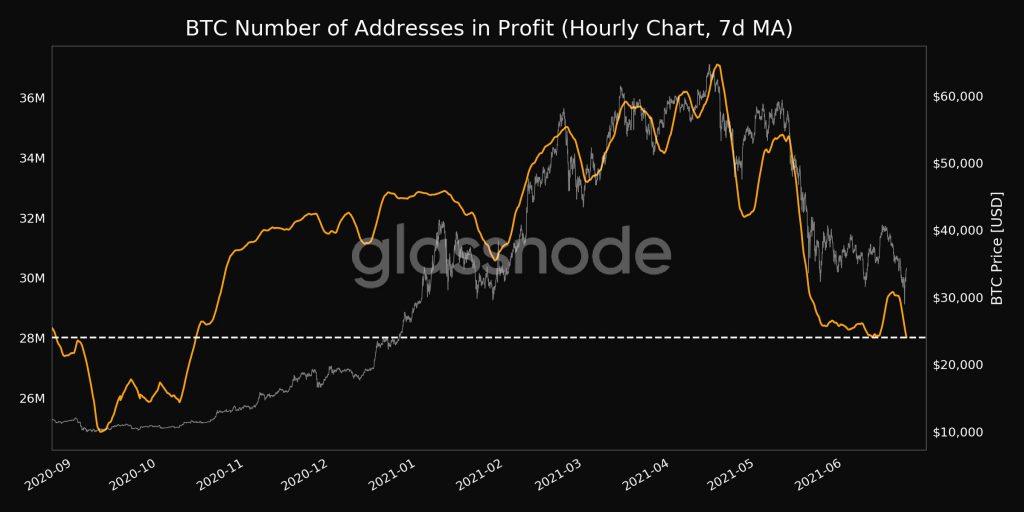

- The number of Bitcoin addresses in profit has hit an 8-month low of 28 million

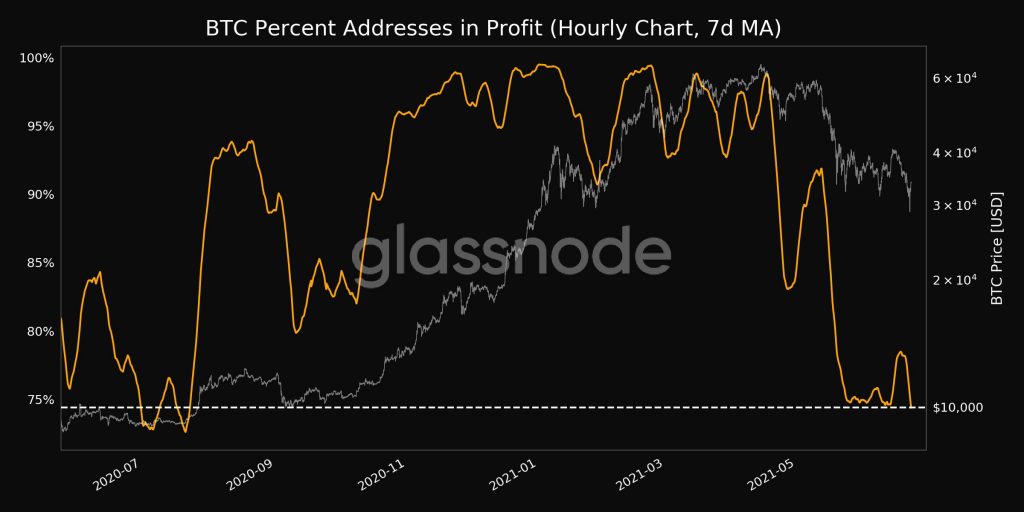

- The percent of Bitcoin addresses still in profit has also hit an 11-month low of 74.387%

- Bitcoin remains in bearish territory below the 200-day moving average with a relief rally possible with the new month of July

- Bitcoin’s 50-week moving average continues to provide a level of support at the $28k to $29k price zone

The number of Bitcoin addresses in profit has just hit an 8-month low of 28 million. This milestone was observed and shared by the team at Glassnode who provided the following chart demonstrating the drop in Bitcoin addresses still in profit.

Bitcoin Percent Addresses in Profit Hits an 11-month Low of 74.387%

The same team at Glassnode also pointed out that the percent of Bitcoin addresses still in profit has hit an eleven-month low of 74.387%. The team at Glassnode went on to share the following chart to demonstrate their findings.

Bitcoin’s 50-week Moving Average Continues to Hold

With respect to price action, Bitcoin is currently trading at the $33k price area after Tuesday’s dip to the local low of $28,805. A quick glance at the daily BTC/USDT chart below, reveals that Bitcoin is still trading below the 200-day moving average (green) with the much-discussed death cross with the 50-day moving average (white) still in play.

From the chart, it can be noted that the local low of $28,800, converges with the 50-week moving average that is providing adequate support between the $28k to $29k zone.

Also from the chart, it can be observed that the volume profile on the far right, is particularly ‘thick’ at the $40k to the $30k price range. This in turn signifies that Bitcoin could very well be trading between this range into the month of July that is only days away.

Both the daily MFI and RSI are hinting at an oversold situation. However, the daily MACD and trade volume highlight continual selling pressure that should abate perhaps with the weekly close on Sunday.