Ethereum App Gets Capital Injection

While Ethereum users have found a number of use cases for the blockchain since its creation, it seems that one use case is eclipsing all the reset — decentralized finance, better known as DeFi. And it seems that venture capitalists in the industry are picking up on this trend.

Announced in a blog published at the turn of the month, InstaDApp, a DeFi portal that aggregates major protocols “using a smart wallet layer and bridge contracts”, has bagged some $2.4 million in funding from investors like Coinbase Ventures, Pantera Capital, Robot Ventures, and IDEO Colab, prominent Silicon Valley investor Naval Ravikant, former Coinbase executive Balaji Srinivasan, “amongst many others”.

Coupled with the funding, InstaDApp brings on Edward Moncada, CEO of Blockfolio and “Ming Ng, who collaborates closely with prominent projects including Handshake, Kyber, and Blockfolio,” to its advisory board.

This funding comes at a key moment for the startup, with its smart contracts seeing locked value growth of 900% over recent months; InstaDApp’s $35 million in locked value is third to MakerDAO and Compound, two other top DeFi applications in the Ethereum ecosystem.

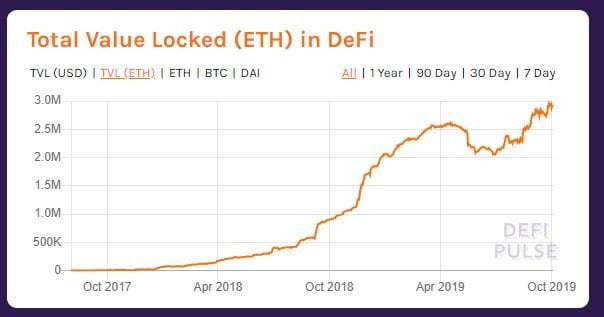

InstaDApp’s extremely successfully seed funding round is a testament to the growth in DeFi over recent months. As seen in this chart published by DeFiPulse below, the amount of locked ETH in contracts for this ecosystem has hit an all-time high, nearing some three million tokens. Crazy.

DeFi… on XRP?

While DeFi has mainly been an Ethereum-centric trend so far, it seems that this newfangled financial system is spreading its wings… at least a little bit.

In a blog post published last week, Ethan Beard, the lead of Ripple’s Xpring investment initiative, revealed that it had brought on Logos Network through an acquisition. Beard wrote that Logo is a ” startup developing a turnkey payments solution focused on speed and scalability.”

As a part of Xpring, Logos will purportedly be focusing their efforts on an “ongoing initiative to explore a DeFi system that will leverage XRP at its core, as well as other ideas we are exploring to leverage crypto to transform payments and finance.

It isn’t clear what an XRP Ledger-based DeFi application would look like, or if it would be better than Ethereum’s in any way; however, the platform and access that Ripple has may enable fintech solutions that cannot be had with something like Ethereum or Bitcoin.

Photo by Eric Muhr on Unsplash