Quick take:

- Equilibrium will soon be onboarded as the 12th parachain on the Polkadot (DOT) network

- The project will also be launching the first order-book DEX with margin trading on Polkadot

- The DEX will allow for high leverage trading using a money market with the lowest collateral requirements ever

The team at Equilibrium has just announced that the project will soon be onboarded as the 12th parachain on the Polkadot (DOT) network. This is after Equilibrium won a slot in a series of intensive auctions.

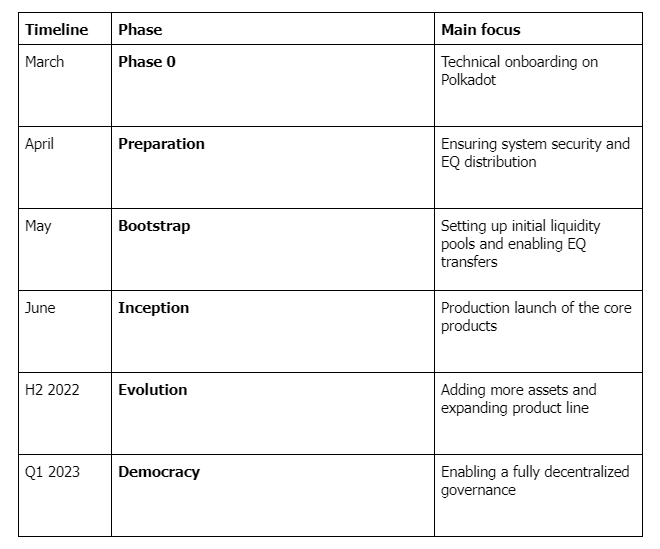

The onboarding of Equilibrium to become a parachain, will commence after the second auction of the current batch ending March 31st. The team at Equilibrium went on to provide the following roadmap for the coming months.

It took Equilibrium roughly two years ‘to become a meaningful part of the ecosystem since the project released [its] whitepaper and started developments on the Substrate framework in February 2020’.

Parachains are special shards on the Polkadot network that allow respective projects and their communities to have a sense of ‘control’ over their goals. Parachain slots are limited and auctioned off through a candle auction depending on the amount of DOT staked/reserved to win them.

According to the team at Equilibrium, its community supported the journey to win a parachain auction through a crowdloan campaign.

The CEO and Founder of Equilibrium, Alex Melikhov, also added that Equilibrium will soon be launching the first order-book DEX on Polkadot with margin trading. He said:

We’ve been extensively building during the past few years and this time has come: very soon we will be launching the first orderbook DEX with margin trading on Polkadot. It will allow for trading with high leverage being combined with a money market that applies the lowest collateral requirements ever. We are sure that these innovations will drive liquidity to the ecosystem and attract advanced market makers along with retail investors