- Daily active addresses on Ethereum have dropped by 11.1% in the last week

- In comparison, Bitcoin’s active addresses have only dropped by 0.7% in the same time period

- Mining revenue for Ethereum has also dropped by 10%

- Ethereum’s mean transaction volume has also hit a one month low

- Goldman Sacks plans to launch Ethereum futures and options

Daily address activity on the Ethereum network has seen an 11.1% drop in the last week. This is according to Coinmetrics’ most recent State of the Network report which also pointed out, that activity on the Bitcoin network has more or less stayed the same with only a 0.7% drop in active address activity in the same time period.

With respect to mining revenue, both Ethereum and Bitcoin miners have seen a 10% drop in the last week as fees continued to decline due to the aforementioned reduction in active addresses on the respective networks.

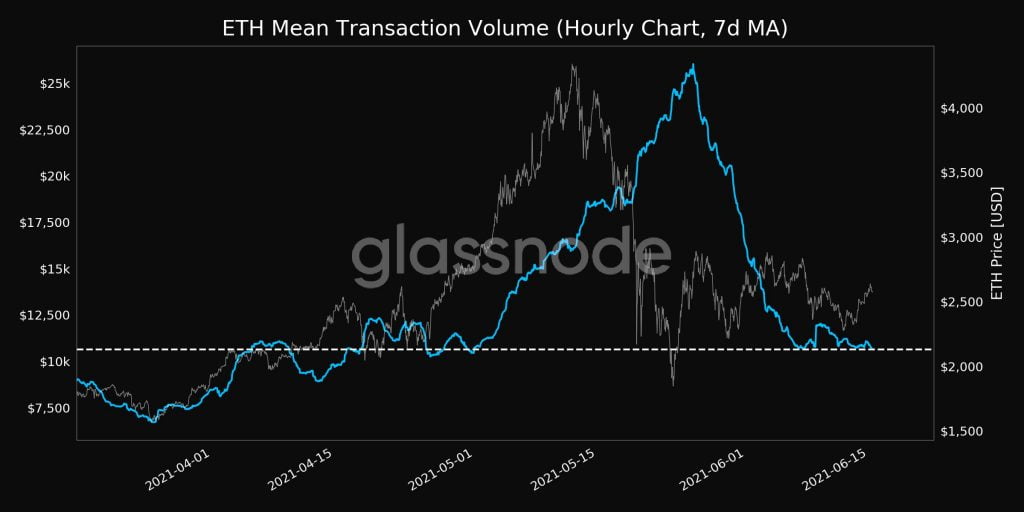

Ethereum’s Mean Transaction Volume Hits a One Month Low

The drop in activity on the Ethereum network was also observed and shared by the team at Glassnode who pointed out, that ETH’s mean transaction volume had hit a one-month low. According to their analysis, the mean transaction volume on Ethereum now stands at $10,638.44 as visualized in the following chart.

Goldman Sacks Plans to launch Ethereum Futures and Options

In other news, the American Investment Bank of Goldman Sachs, announced yesterday, that it was in the process of offering Ethereum futures and options to its clients.

The head of digital asses at Goldman Sachs, Mathew McDermott, further explained that demand for Ethereum investment products was the main reason behind the decision. Mr. McDermott further elaborated on this through the following statement in an interview with Bloomberg.

We’ve actually seen a lot of interest from clients who are eager to trade as they find these levels as a slightly more palatable entry point. We see it as a cleansing exercise to reduce some of the leverage and the excess in the system, especially from a retail perspective.