- Grayscale has updated the list of digital assets it has been exploring as potential additions to its product offerings

- Grayscale has added 13 digital assets to the list including Polygon (MATIC) and Solana (SOL)

- Grayscale now has $34.4 Billion in assets under management

- In the last 30 days, Grayscale has purchased several altcoins including Filecoin, Chainlink, MANA, Liverpeer, ZEC, BCH and Litecoin

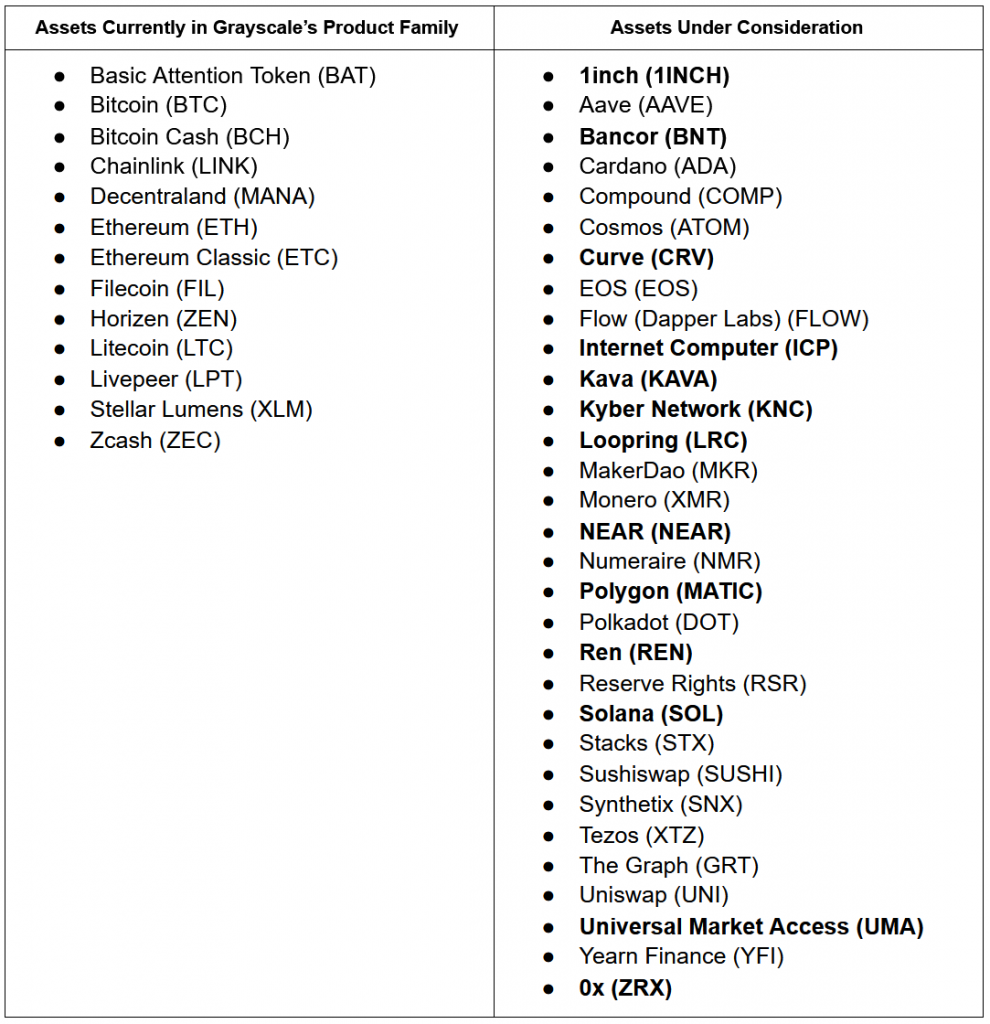

The Wall Street investment firm of Grayscale has updated the list of digital assets it has been exploring for potential addition to its product offerings. The new list includes the following 13 digital assets.

1inch (1INCH), Bancor (BNT), Curve (CRV), Internet Computer (ICP), Kava (KAVA), Kyber Network (KNC), Loopring (LRC), NEAR (NEAR), Polygon (MATIC), Ren (REN), Solana (SOL), Universal Market Access (UMA), and 0x (ZRX)

A complete list of digital assets under consideration by Grayscale can be found in the following table alongside those that already part of the family of products.

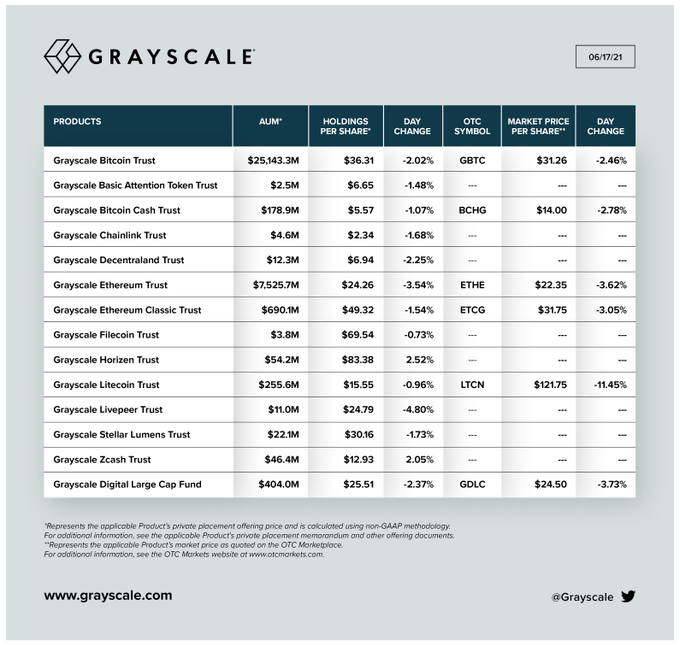

Grayscale Now Has $34.4 Billion in Assets Under Management

In another update, the team at Grayscale made public that the firm now has $34.4 Billion in digital assets under its management. The following infographic further breaks down the value of each of the company’s active investment products as of June 17th, 2021.

Grayscale Adds Several Altcoins to its Portfolio in the last 30 Days

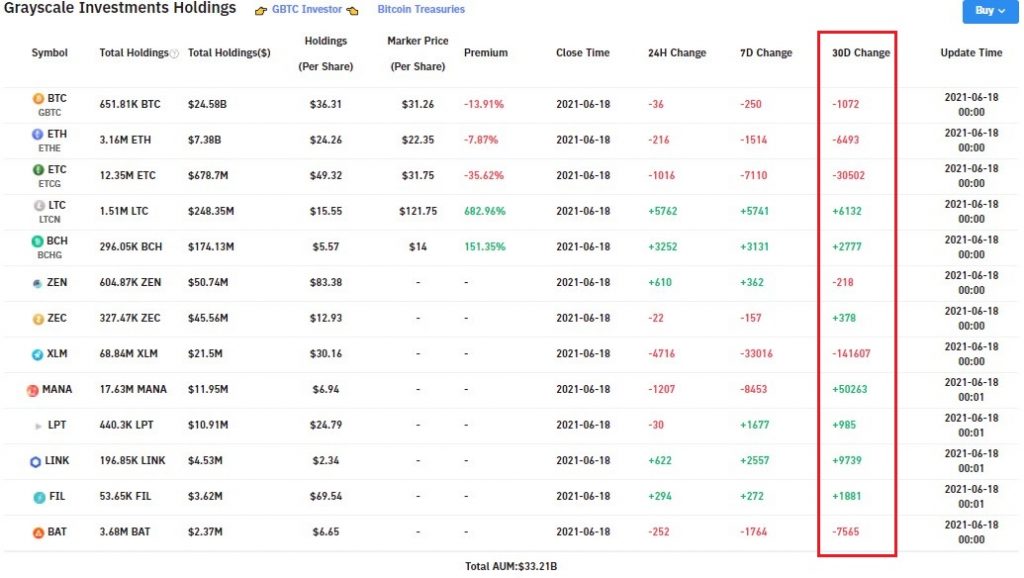

With respect to new purchases of digital assets by Grayscale, the firm has mostly added altcoins to its holdings in the last 30 days as highlighted in the following table courtesy of Bybt.com.

From the data above, it can be observed that in the last 30 days, Grayscale has accumulated considerable amounts in Litecoin, Bitcoin Cash, ZCash, Decentraland (MANA), Liverpeer (LPT), Chainlink (LINK), and Filecoin (FIL).

From the data above, it can be observed that in the last 30 days, Grayscale has accumulated considerable amounts in Litecoin, Bitcoin Cash, ZCash, Decentraland (MANA), Liverpeer (LPT), Chainlink (LINK), and Filecoin (FIL).

In the same time period, Grayscale has offloaded some of its holdings in Bitcoin, Ethereum, Ethereum Classic, Horizen (ZEN), Stellar (XLM) and Basic Attention Token (BAT). The outflows of these digital assets are not a large portion of Grayscale’s holdings and should not be a cause of concern for retail investors.

However, the outflows are a confirmation of reduced interest in these products by institutional investors as the crypto markets lean towards a bear market.