Quick take:

- Binance has launched a DeFi composite Index perpetual contract

- The DEFI/USDT index will go live on the 28th of August, 7 am UTC

- The index is made up of 10 DeFi tokens: BAND, COMP, KAVA, KNC, LEND, LINK, MKR, SNX, SXP and ZRX

- As with all indices, its value will be calculated using a weighted average

- LINK constitutes 28% of the DeFi Index

The team at Binance has announced that they will be launching a DeFi composite index perpetual contract. The sole purpose of the index is to provide crypto traders with a chance to trade the DeFi market rather than the individual digital assets.

The team at Binance further explained that the maximum allowable leverage would be 50x once the index is launched on the 28th of this month at 7 am UTC.

Binance Futures will launch a DEFI/USDT composite index perpetual contract, with trading opening at 2020/08/28 7:00 AM (UTC). The DEFI/USDT Composite Index perpetual contract is a USDT-margined futures contract that uses USDT as collateral. Users will be able to select between 1-50x leverage.

DEFI/USDT Index Tracks a Basket of DeFi Tokens

Tracking and trading the prices of individual tokens is usually a cumbersome task but the DeFi index provides an easier method of doing so. The DEFI/USDT index will derive its value from a list of 10 tokens through a weighted average price of the components. The DEFI composite index perpetual contract will be composed of the following digital assets.

- Band Protocol (BAND)

- Compound (COMP)

- Kava.io (KAVA)

- Kyber Network (KNC)

- Aave (LEND)

- Chainlink (LINK)

- Maker (MKR)

- Synthetic Network Token (SNX)

- Swipe (SXP)

- 0x (ZRX)

ChainLink Takes up 28% of the Index

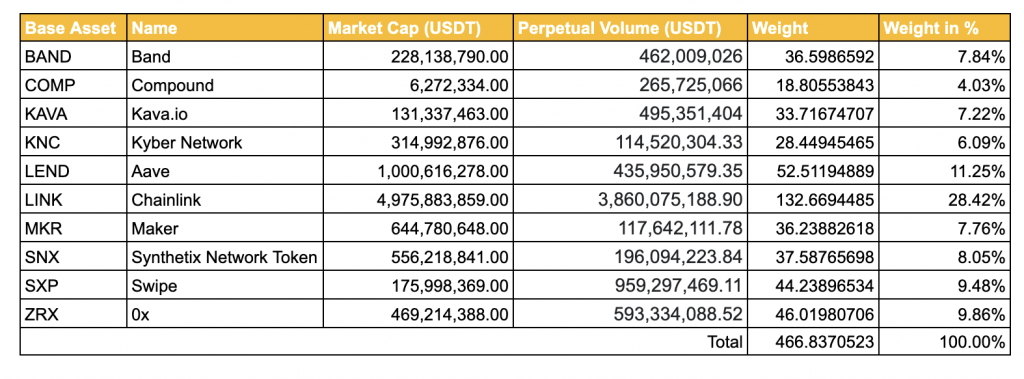

Below is a detailed explanation of the constituents of the DeFi index courtesy of Binance. From the table, it can be observed that ChainLink takes up 28.42% of the value of the DeFi index followed by LEND which has been allocated 11.25%.

Regular Rebalances and Adjustments to the DEFI/USDT Index

Due to the ever-changing nature of the crypto markets, the DeFi composite index will be rebalanced every Thursday at 7 am UTC based on the latest market information. Furthermore, the index will go through adjustments in the case of the delisting of a constituent or a reduction in its organic trade volume. Additional information on the DEFI index can be found on the Binance page introducing the new product.