In all industries, when some analysts speak, people listen.

For the equities markets, an analyst/investor that falls into this category is Warren Buffet, the billionaire stock guru that has large stakes in some of America’s most prominent companies. (Buffet is also a notable cynic of cryptocurrencies, especially Bitcoin, which he claims has no inherent value and is an asset for charlatans.)

In cryptocurrency, there are a few of these extremely respected investors. One of these is AngeloBTC, a Bitcoin trader that rose to fame in 2017’s bull market after making some crazy calls (one includes XRP’s massive rally at the end of the last bull cycle).

Angelo recently broke his silence on Twitter — he barely posts any longer — to issue the tweet below, in which he stated that he’s “patiently waiting for $6,000 Bitcoin, [which is] where I will add to [my] long-term holdings.” Angelo’s latest tacit target comes after he effectively called the move to $8,000 at the end of August.

Patiently waiting for $6k $BTC levels where I will add to long-term holdings.

Good luck homies.

— AngeloƉOGE (@AngeloBTC) October 15, 2019

So, will Angelo be right this time around?

Apparently so, according to some analyses.

Bitcoin to Drop by 25% to $6,000

Timothy Peterson, an analyst at Cane Island Alternative Advisors, recently argued that there is a clear “relationship between the premium investors pay for OTC shares of Grayscale Bitcoin Trust (GBTC) and the cryptocurrency’s Price.” Indeed, as can be seen through the investor’s post, BTC has tracked the GBTC premium per share over the course of the entire yet.

#Bitcoin could drop to $6,000 according to $GBTC's premium.https://t.co/voRfhL8mm9

— Timothy Peterson (@nsquaredcrypto) October 11, 2019

“The relationship between GBTC premium and bitcoin price has not been stable and predicable over time. However, our fundamental models also value BTC at about $6,000. It appears that institutional and long-term US investors in GBTC are expecting this price level for BTC as well.”

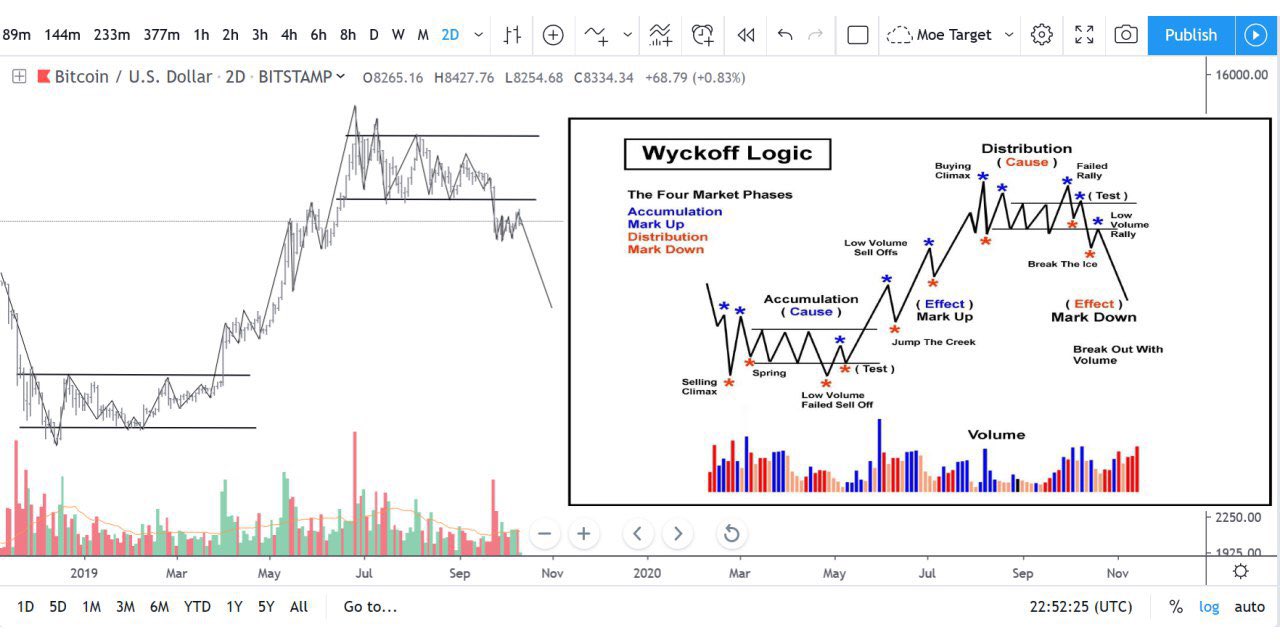

That’s not all. As reported by Ethereum World News previously, an analyst has argued that since December 2018, BTC’s chart has looked exactly as defined by the four market phases defined in Wyckoff Logic, a way of looking at markets created by prominent historical investor Richard Wyckoff: accumulation, mark up, distribution, mark down.

The logic suggests that Bitcoin is in the midst of the bearish phase of markets, the mark down. Analyst Moe Mentum’s interpretation of the Logic shows that in the coming weeks, BTC may begin another -20%+ leg lower to $6,000 or potentially even deeper.

Photo by Dmitry Demidko on Unsplash