- Switzerland’s SEBA Bank has launched an Ethereum staking service for institutional clients.

- The bank is fully regulated and says clients have been asking for staking services.

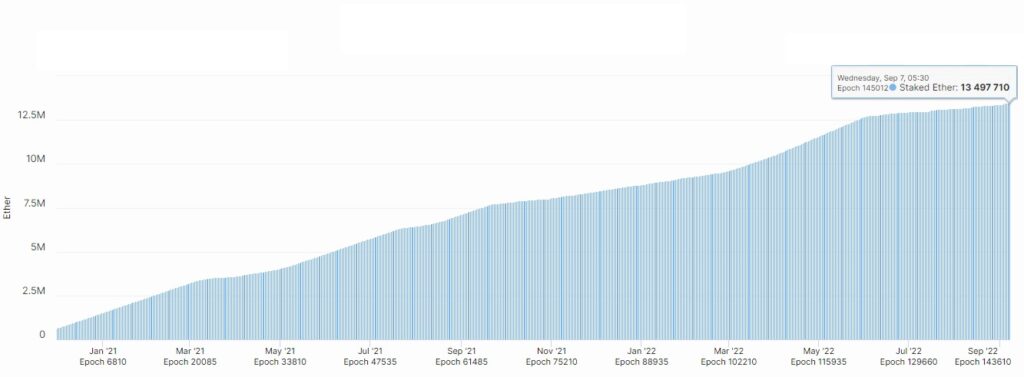

- Ethereum staking and the number of validators have also hit all-time highs.

Switzerland’s SEBA Bank has launched a staking service for institutional clients, just as Ethereum’s Merge is set to take place. The bank published a press release on September 7 saying that it caters to demand from institutions who show interest in such services as staking and DeFi.

The bank’s staking management platform allows clients to stake on a variety of protocols, including Ethereum, Polkadot, and Tezos. It plans to add support for additional protocols in the future.

Speaking on the demand for these services and The Merge itself, SEBA Bank’s Head of Technology & Client Solutions Mathias Schütz says,

“The Ethereum merge is an anticipated and significant milestone for the world’s second largest cryptocurrency, delivering improvements for its users across the areas of security, scalability and sustainability. The launch of our Ethereum staking services will enable institutional investors to play a key role in securing the future of the network, via a trusted, secure and fully regulated counterparty.”

The SEBA Bank is a crypto bank that is fully regulated and provides a wide variety of solutions, including trading and credit services. With staking on Ethereum, it hopes to bring in institutional clients who wish to help secure the network.

Ethereum Staking Numbers Reaching New Highs

As Ethereum is all set to become a Proof-of-Stake network, the number of validators and staked ETH has reached all-time highs. Daily active validators are now at over 421,000, while the amount of staked ETH is at nearly 13.5 million.

Several analysts have been discussing the impact of The Merge on the price of Ethereum, with many seeing a good run for the asset going forward. Evan Van Ness, a prominent figure in the crypto space, said on Twitter that Proof-of-Stake also offers economic security, saying that the cryptocurrency could withstand up to $25 million in monthly sell pressure.

He also mentioned the other important point that ETH staking rewards will become liquid in the near future, which will bring more stakers on board. This will add additional buying pressure as well.

The next few days are going to bring intense discussion about the future of Ethereum. The prospects look good at the moment, with a major upgrade tantalizingly close and more important ones coming up over the next few years.