Quick take:

- The Coronavirus crash of mid-March shook up the crypto markets in a huge way.

- A quick analysis of Stellar and XRP results in the conclusion that XLM has outperformed XRP since then.

- With holders of XLM qualifying for inflation rewards, more investors might be shifting their interest away from XRP.

The end of the first quarter of 2020 was marked by a massive drop in both the stock and crypto markets due to the panic surrounding the global economic effects of the Coronavirus. The selling panic in mid-March was nicknamed the Coronavirus Crash and was characterized by all digital assets – such as Bitcoin, Ethereum, XRP, Litecoin, and Stellar (XLM) – experiencing a massive dip on or around the 13th of March.

Recovery of XRP Since the Crash in mid-March

During the crash, XRP dipped to as low as $0.10 from steady levels around $0.25. At the time of writing this, XRP is valued at $0.192 indicating that it has recovered by a factor of 0.768x (76.8%) of the value before the Coronavirus crash.

Further checking the daily XRP/USDT chart courtesy of Tradingview.com, the following can be concluded.

- The crucial $0.20 support price has once again been lost.

- MACD and MFI indicate that XRP/USDT might be headed towards bear territory for the rest of the month of June.

- $0.18 to $0.17 provides the next level of valuable support failure to which, XRP could revisit either $0.15, $0.12, or the earlier mentioned $0.10 support zone.

- XRP’s current price is slightly above the 50-Day (white) moving average but below both the 100-Day (yellow) and 200-Day (green) moving averages. This further pleads the case of a bearish scenario for the remittance coin.

Recovery of XLM Since the Coronavirus Crash

Doing a similar analysis of XLM, we find that during the Coronavirus crash, the digital asset dropped from a value of $0.06 to around $0.026. At the time of writing this, XLM/USDT is trading at a value of $0.0729. This indicates that XLM has more than recovered from the Coronavirus crash by a factor of 1.215x (121.5%) and thus succeeded in outperforming XRP in the same time period.

Further checking the daily XLM/USDT chart courtesy of Tradingview.com, the following can be concluded.

- XLM/USDT is in a clear downtrend indicated by a red trade volume.

- The MACD has crossed in a bearish manner above the baseline with the MFI also pointing towards a retracement.

- However, the current price of $0.0729 is above the 50-day, 100-day and 200-day moving average further providing some adequate support zones at $0.070 and $0.058 respectively.

- There is also a very valid golden cross that will be tested in the days to come as Bitcoin looks set to test levels below $9,300.

Inflation Rewards of XLM Made Easier by Binance

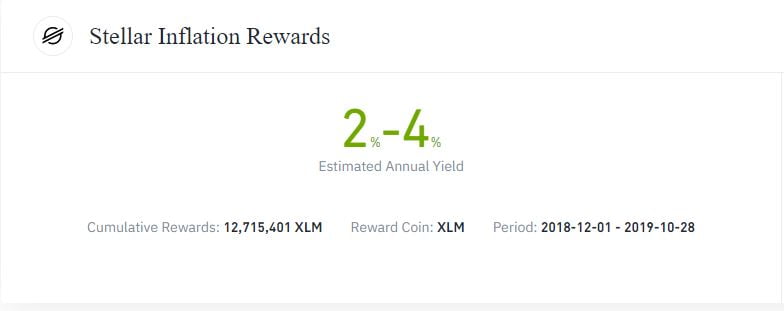

One possible reason for XLM outshining XRP, besides a relatively more bullish chart, is the fact that claiming inflation rewards of XLM has been made easier by Binance. The latter exchange facilitates an estimated annual yield of between 2 – 4% in XLM from holding the digital asset on the platform.

In Conclusion

Summing it up, Stellar (XLM) has had a perfect recovery since the Coronavirus crash when compared to XRP. Stellar’s performance might be further boosted by the ease of claiming XLM inflation rewards via Binance.

Additionally, XRP has had a rough few months in the crypto markets with its former number 3 spot on Coinmarketcap now permanently occupied by Tether (USDT). However, there could be hope for XRP as it is still in an earlier observed falling wedge that could resolve to the upside.