Ripple’s partnership with the payment service provider MoneyGram is remarkably picking up the pace according to Tenitoshi, an analyst based in Japan. The tremendous volume has been experienced mostly on Bitso.

The data previously analyzed by Tenitoshi placed XRP Liquidity Index somewhere in the negative for the Mexican region. This shows how markets were having it hard to recover from the slump endured throughout 2018. Tenitoshi explained:

“In principle, market volume cannot be negative. But the calculation of the index sometimes outputs negative values undesirably. It tends to happen if a market is no liquid or very volatile. But those absolute values are negligibly small. So you can think of it as near-zero.”

The partnership between Ripple and MoneyGram back in June provided that the payments guru uses XRP in its cross-border transfers. In return, Ripple invested $50 million in MoneyGram. The partnership was strategically pushed to ensure XRP adoption grows to new regions across the world.

MoneyGram adopted XRP not because of the $50 million investment by Ripple but because of the potential that the asset holds as means of remittance. Ripple’s CEO Brad Garlinghouse told CNBC that the partnership with MoneyGram impact on the market will be massive, even bigger than the anticipated Facebook’s Libra project.

Action can already be seen on cryptocurrency exchanges such as Bitso. The XRT-to-Mexican peso volume has been skyrocketing. The development also shows that the decision to support remittance services has started to yield.

XRP Market Update

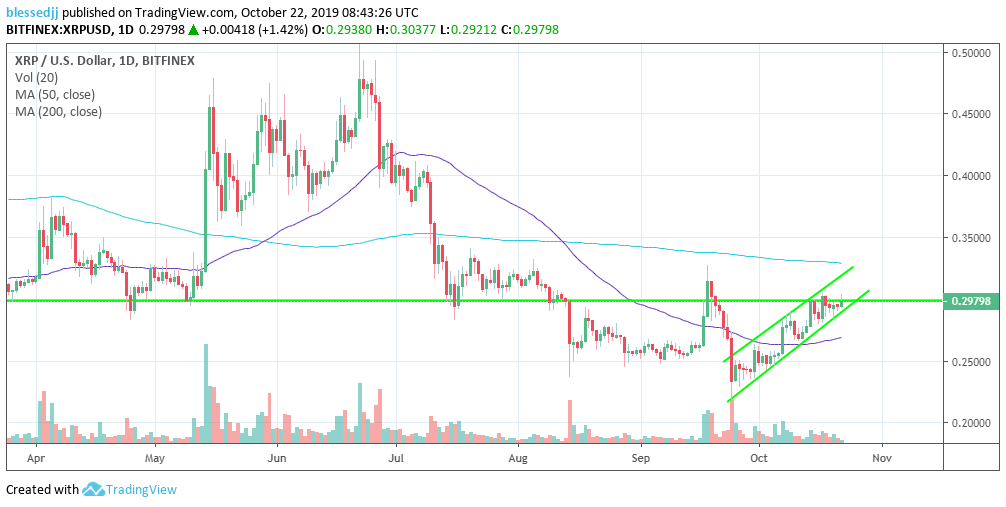

Ripple’s XRP performance in the last three weeks has been impressive. The downtrend from the highs above $0.50 achieved in June 2019 appears to have found a bottom around $0.22. The recovery that followed sustained gains within an up-trending channel. Despite the recovery, Ripple is trading at $0.2976 while fighting the stubborn resistance at $0.30. On the other hand, the narrowing gap between the 50-day Moving Average (MA) and the 200-day MA suggests that the bulls will continue to gain traction against the bears.

XRP/USD daily chart