In brief:

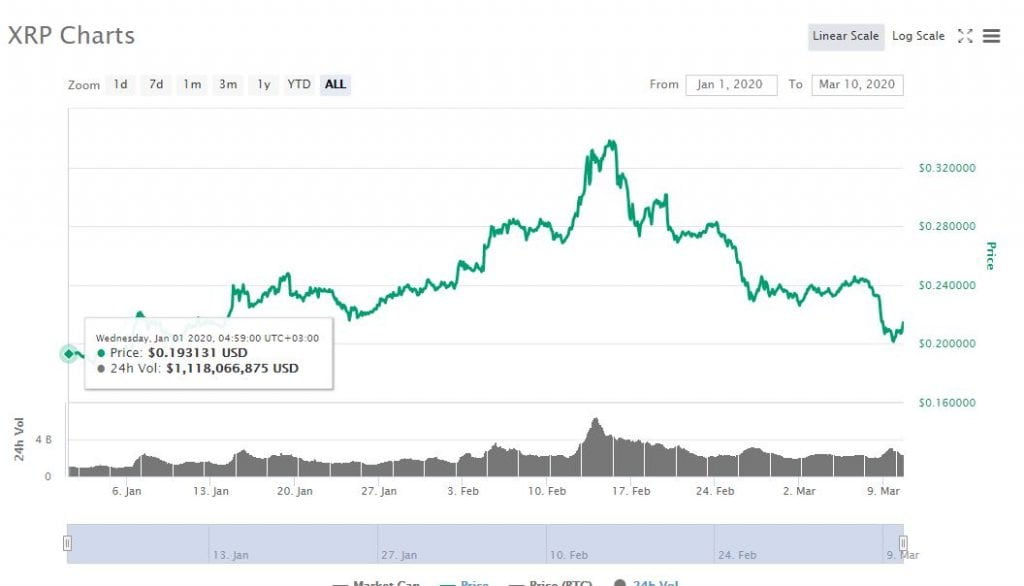

- XRP opened 2020 at a value of $0.193.

- Its current value of $0.214 is 10% higher than on January 1st, 2020.

- Veteran crypto analyst believes it might get worse before it gets better for XRP.

March 9th, 2020, will go down in history as one of the most tumultuous days of trading in both the stock and crypto markets. We witnessed situations where trading was even halted for 15 minutes on the major trading floors in the United States due to the rapid decline of stocks, indices, futures, equities, bonds and oil. The panic selling was as a result of the economic effects brought about by the global spread of the Coronavirus as well as the Oil price wars between Saudia Arabia and Russia. The top 3 cryptocurrencies of Bitcoin (BTC), Ethereum (ETH) and XRP were also not spared.

XRP Still Up 10% from its January 1st Value

Extending our focus on XRP, we find that its current value of $0.214 at the time of writing this, is still 10% higher than its January 1st open price of $0.193. The remittance coin seems to have found some temporary support at $0.20 as the crypto markets take a breather from yesterday’s chaos.

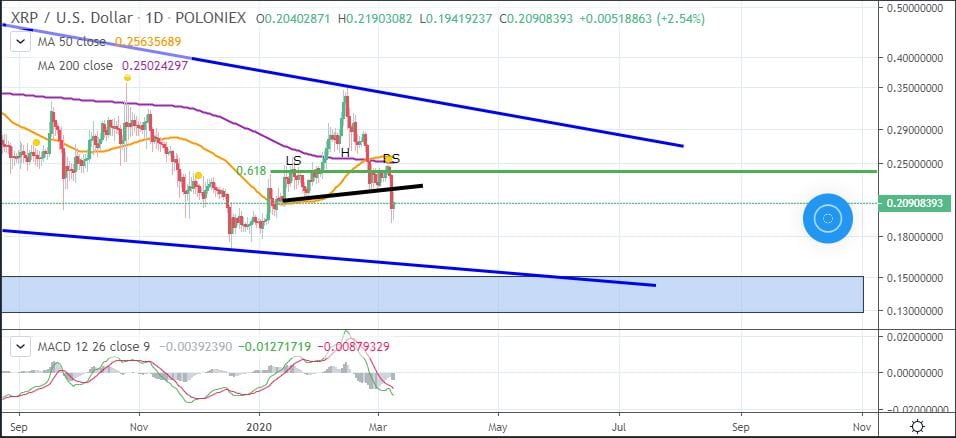

It Might Get Worse for XRP Before it Gets Better

However, with talks of a global recession and Bitcoin (BTC) failing to show its might as a store of value, it might get worse before it gets better for XRP in the markets. In a recent Trading View analysis of XRP, veteran crypto analyst @MagicPoopCannon illustrates how the coin is in a falling wedge. He expects XRP to find some support between $0.15 and $0.16 in the months ahead.

To add to his analysis, the stock and crypto markets seem to extend their free fall due to the global spread of COV19. This means that any positive news about defeating the virus might be one clear way of identifying signs of a trend reversal in both the stock and crypto markets.

(Image courtesy of Unsplash.com)