Summary:

- The blockchain startup suggested connecting Uniswap V3 to BNB Chain, the second-largest DeFi ecosystem with over a million active user addresses and $5 billion in total value locked.

- 0xPlasma Labs argued that deploying on BNB will expand utility and trading on the decentralized exchange beyond Ethereum’s network.

0xPlasma Labs submitted a governance proposal aimed at deploying Uniswap v3 on DeFi’s second-largest blockchain network by trading volume and active users – BNB Chain. The startup, 0xPlasma Labs, builds tools to complement the crypto decentralized exchange (DEX).

Ilia Maksimenka, the CEO of 0xPlasma who published the proposal, argued that Uniswp could onboard more than a million active users and an additional $1 billion in total value locked (TVL). Ethereum topped the TVL on the DEX with $2.3 billion out of $2.5 billion when this report was written.

DeFiLlama data showed Ethereum Layer 2 protocols Polygon ($26.7 million) and Arbitrum (83.5 million) were the second and third largest by TVL on the DEX. Maksimenka’s plan added that bringing BNB Chain into the fold will earn the respect of decentralized finance solution builders and boost adoption for Uniswap’s NFT platform.

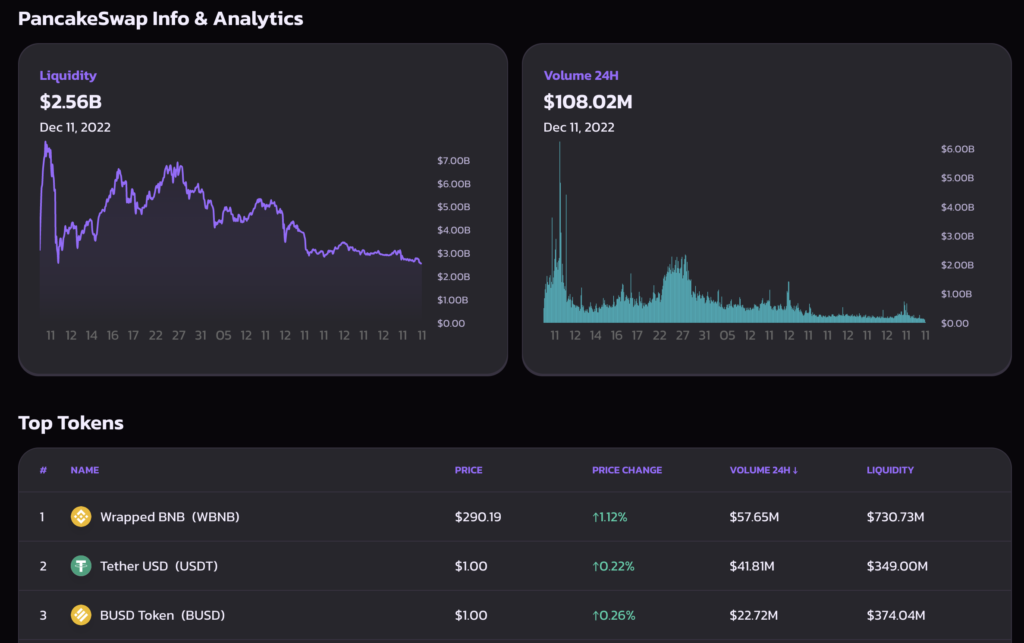

The proposal was in discussion at press time. It’s unclear whether the community will agree with 0xPlasma Labs that Uniswap’s third iteration or V3 should deploy on BNB Chain. Notably, the move could intensify competition with Pancakeswap, the leading DEX on Binance’s blockchain.

BNB Chain was launched in September 2020 by leading crypto exchange Binance. The BNB token initially lived on Ethereum’s network before Binance migrated the coin to its own decentralized network.

Ethereum’s Most Active Smart Contract – Uniswap V3

Data from Tokenterminal showed that Uniswap topped other protocols in terms of gas consumption. Gas refers to the fees paid by traders when sending cryptocurrencies. The smart contract code powering the DEX used around $4.4 million in gas fees, making Uniswap the most active smart contract on Ethereum.

Stablecoin Tether USD (USDT) and on-chain solution CoinTool were ranked second and third. Their gas estimates were $3.9 million and $3.7 million respectively at press time.

In other news, the DEX was the center of controversy after an updated privacy policy was announced to the community. Uniswap also debuted NFT trading and a $5 million USD Coin (USDC) airdrop for Genie users.