- Elon Musk’s $43 billion Twitter acquisition includes support from major stakeholders in the crypto industry

- Andresen Horowitz Binance, Fidelity, and Sequoia represent some of the biggest equity backers in the deal

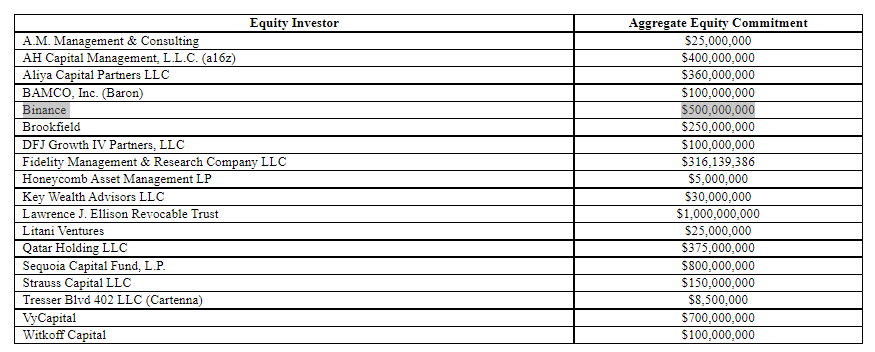

New developments reveal that Elon Musk is not the sole equity provider in the massive $43 billion acquisition of social media network Twitter. According to an updated 13-D document filed with the SEC, the world’s largest exchange Binance has committed a massive $500 million to the financing of the deal.

CEO Changpeng Zhao also confirmed the news via a tweet on Thursday.

Elon Musk reportedly launched his bid after splurging $2.98 billion to acquire a 9.2% stake in the social media giant earlier in March. Shortly after turning down a seat on the company’s board, the Tesla boss announced plans to buy the company and unlock its true potential.

Notably, Binance is not the only cryptocurrency-related outfit providing funds for the historical takeover. The filing also shows that digital asset investment giant Fidelity has invested $316 million in the deal.

Venture capitalist behemoths Andreessen Horowitz and Sequoia have also committed a combined $1.2 billion for Elon’s Twitter takeover.

The single largest contribution comes from Lawrence J Ellison Revocable Trust with $1 billion in equity.