Summary:

- Ether and ERC20 deposits on centralized crypto exchanges surpassed withdrawals on centralized crypto exchanges as FTX contagion rattled digital asset markets.

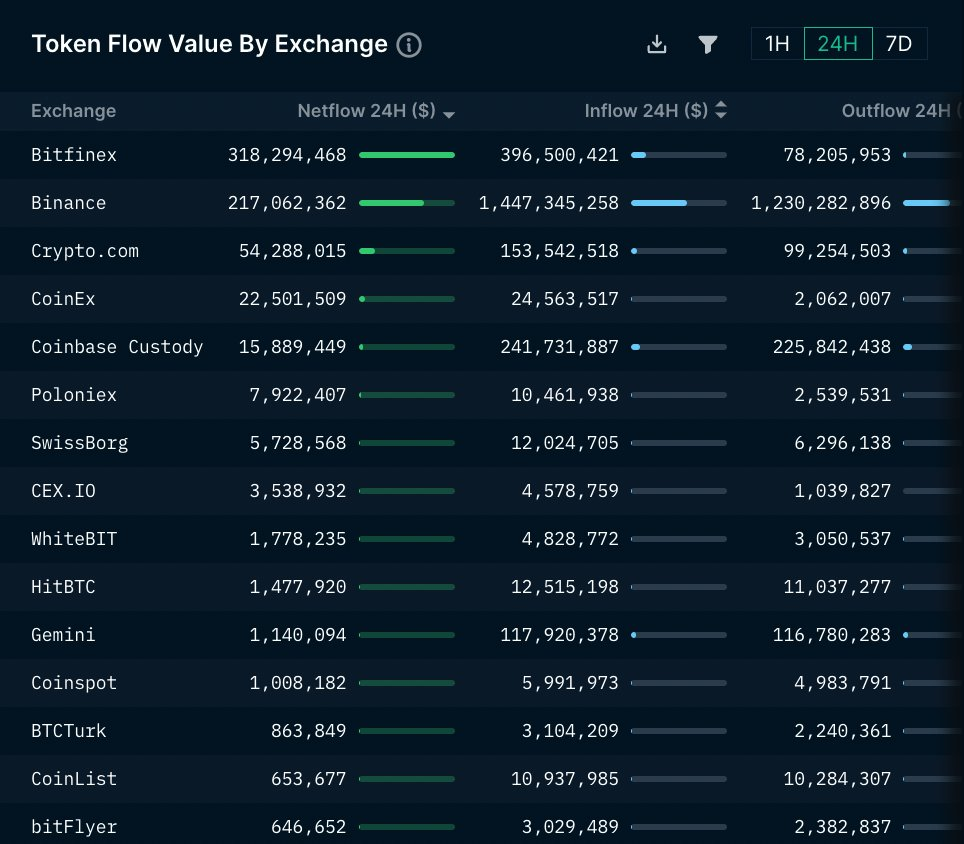

- Tether-backed Bitfinex and leading exchange Binance topped the list for token inflows, per Nansen data.

- Platforms like Coinbase, Kucoin, and OKX saw more outflows than deposits.

Leading centralized crypto exchange Binance and Tether-backed Bitfinex topped the list for the highest Ether (ETH) and ERC 20 token inflows. The data seen via Nansen on Tuesday tracked exchange inflows and outflows on crypto exchanges, otherwise known as deposits and withdrawals.

Binance leads overall deposits over 24 hours with around $1.4 billion in ETH and other tokens tradable on Ethereum’s blockchain. Bitfinex – the crypto exchange backed by USDT issuer Tether – led total ERC20 token Netflow with some $318 million in digital coins.

Other ranking exchange deposits included Coinbase’s custodial service and Crypto.com despite doubts surrounding the platform’s reserves and proof of assets.

Withdrawals eclipsed deposits on crypto exchanges like Coinbase, FTX-backed KuCoin, Gateio, and OKX to name a few. Crypto Twitter called out Crypto.com and Gateio for “lack of transparency” after ETH transactions between the platforms caused a stir.

Gateio has since published proof of reserves including liabilities along with crypto exchanges like Kraken.

CEXs Like Binance See Inflows While FTX Saga Unfolds

Indeed, Nansen’s data suggests that customer confidence in CEXs might not be completely shattered considering FTX’s bankruptcy. The failure of the major exchange shook the industry and left crypto users without access to billions in digital assets.

FTX collapsed a few months after Terra’s $40 billion implosion crippled centralized crypto startups like BlockFi, Celsius, Three Arrows Capital, and Voyager Digital. At the time, Sam Bankman-Fried offered loans and lifelines to BlockFi and Voyager Digital in a so-called attempt to bail out crypto markets.

Contagion from SBF’s alleged fraud and the fallout from FTX’s portfolio has not unraveled completely, the general sentiment on CT suggests. The chapter 11 bankruptcy filed in Delaware mentioned 130 companies linked to FTX and Alameda.