- A report by Forbes found that Binance transferred nearly $1.8 billion worth of stablecoins collateral to hedge funds last year.

- The beneficiaries included Justin Sun, Cumberland, and Sam Bankman-Fried’s Alameda Research.

- Forbes has claimed that the transfer of assets was similar to maneuvers made by FTX before its implosion.

- A spokesperson for the exchange clarified that there was no commingling of funds.

A sensational report published by Forbes earlier today shed a light on a series of transfers made by the world’s largest crypto exchange, Binance, last year. The transfers involved more than a billion dollars worth of assets that were meant to back stablecoins belonging to the exchange’s customers. Forbes claimed that the transfers were “eerily similar” to FTX’s activities before its implosion.

Binance transferred stablecoin collateral to Alameda Research

According to on-chain data gathered by Forbes, the transfers started on 17 August last year. Binance reportedly transferred the funds that backed $1 billion worth of B-peg USDC belonging to its customers, to multiple hedge funds. The report found that the B-peg USD Coins were left with no collateral till as late as December 2022. This went against the crypto exchange’s long-standing claim that the B-peg tokens it issued are backed 1:1.

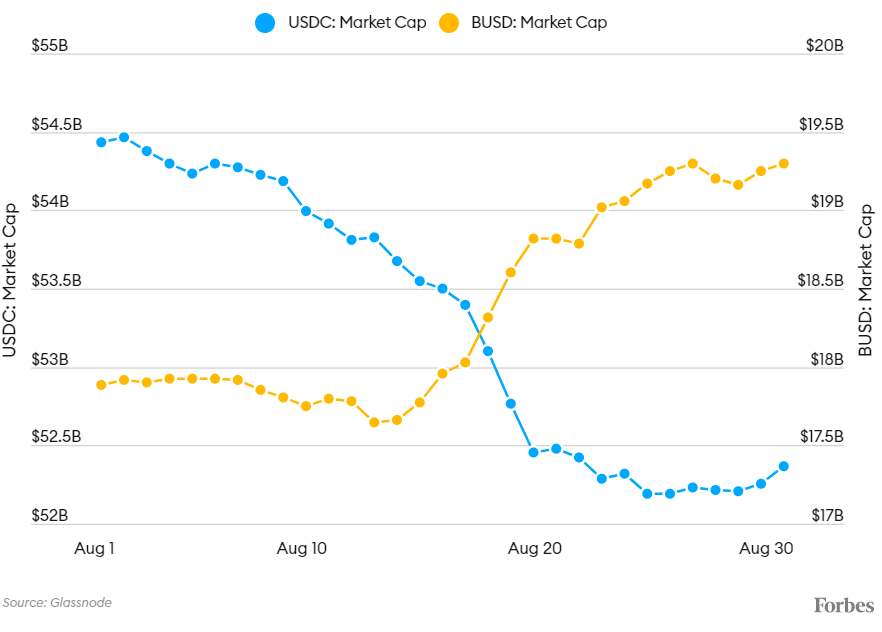

Of the $1.8 billion that was transferred out of the crypto exchange’s peg wallet without informing the customers, nearly $1.1 billion was sent to Cumberland, a crypto trading firm based in Chicago. Forbes report claimed that Cumberland may have helped Binance to convert the stablecoin collateral into its own stablecoin, BUSD, as part of the crypto market’s aggressive campaign to increase BUSD’s share in the stablecoin market. The report found that BUSD’s market cap increased, while rival stablecoin USDC’s stablecoin decreased amid these transfers.

The assets were shifted from the peg wallet to Binance 8, the exchange’s cold wallet, and subsequently into its hot wallet. The assets were returned to the peg wallet after seven days. Other beneficiaries of the transfer include Tron founder Justin Sun, who received $138 million, and crypto trading outfit Amber Group, which received $43 million. Interestingly, Sam Bankman-Fried’s crypto hedge fund Alameda Research received $20 million from the exchange.

There was no commingling”

Patrick Hillmann, Chief Strategy Officer of Binance

While Cumberland and Amber Group did not respond to Forbes’ request for comment, Binance’s Chief Strategy Officer Patrick Hillmann suggested that the transfer of assets within the exchange’s wallets was part of its daily business activities. He also revealed that other than the wallets, the exchange had ledgers that kept track of all funds owed to customers and tokens that were moved around between wallets.