Quick take:

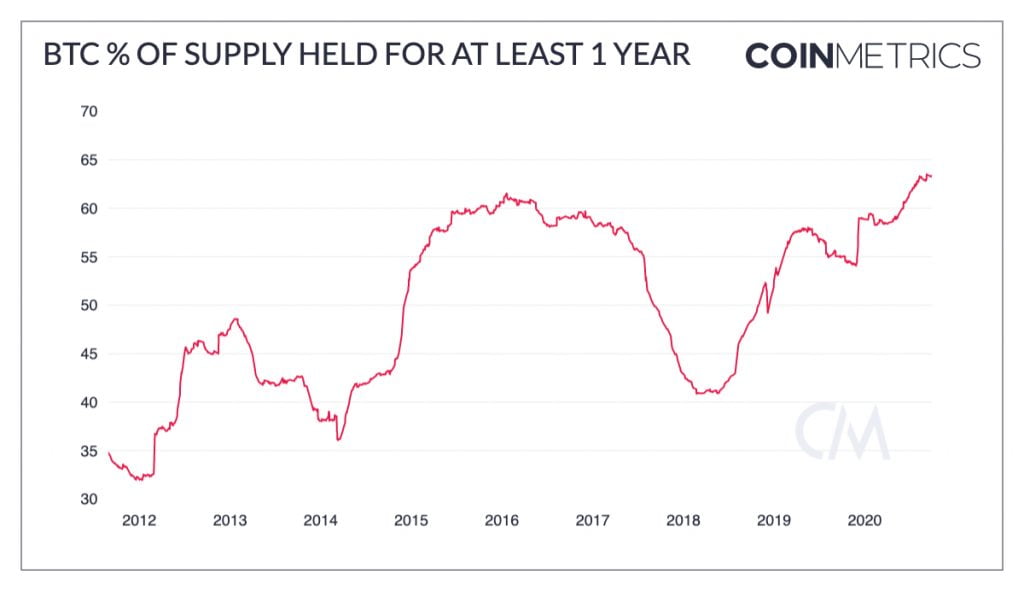

- Investors are increasingly holding Bitcoin as a store of value

- Bitcoin supply held for over 1 year hits its highest level since 2010 at 63.5%

- Bitcoin has now stayed above $10k for the longest time period at 64 days

- BTC is facing a monthly close in the next 24 hours

The team at Coinmetrics has released their weekly State of the Network report in which they highlight that Bitcoin is increasingly being used as a store of value. This fact is demonstrated by the fact that 63.5% of Bitcoin’s supply has been held for over one year; the highest since 2010. The report went on to provide the following chart demonstrating the high percentage of Bitcoin’s supply that has been held for over a year.

Bitcoin has Traded Above $10k for a Record 64 Days

Furthermore, Bitcoin hit a new milestone in the form of the number of days BTC has traded above the psychological support of $10,000. For 64 days, Bitcoin has traded above $10,000 with the last record of 62 days witnessed between December 2017 and January 2018.

Bitcoin’s milestone was highlighted yesterday by Anthony Pompliano via the following tweet, and when the record was 63 consecutive days above $10k.

Dear Bitcoin haters,

Bitcoin has spent a record 63 straight days above $10,000 and is only showing signs of going higher.

The market is proving your bearishness wrong. There is always time to capitulate & join the party :)

Love,

Pomp— Pomp 🌪 (@APompliano) September 28, 2020

Bitcoin Faces a Monthly Close in the Next 24 hours

Bitcoin also has another pending milestone in the form of a monthly and quarterly close in the next 24 hours.

Bitcoin is very much on a path to close Q3 on a positive note despite the rocky market environment experienced in the first week of September. If Bitcoin closes at its current level of $10,675, BTC would close Q3 17.3% in profits.

However, it is also prudent to remember that a lot can happen in the crypto markets between now and September’s monthly close. At the time of writing, several events related to the US Elections and the state of the global economy could rock Bitcoin’s fortunes in either direction.

For example, US House Democrats are musing on the possibility of a second stimulus bill that could guarantee US residents another round of $1,200 stimulus checks. If the bill is passed, both Bitcoin and the stock markets will react positively as was witnessed last time. Additionally, any negative news related to the Coronavirus will also affect how Bitcoin closes Q3 of 2020.