Summary:

- Some 50% of Bitcoin holders are at a loss amid sagged crypto prices.

- “out-of-money” Bitcoin addresses made up over half of all holders for the first time since March 2020, IntoTheBlock data showed.

- The analysis highlighted that around 24 million wallets bought BTC cheaper than Monday’s $16,050 market price.

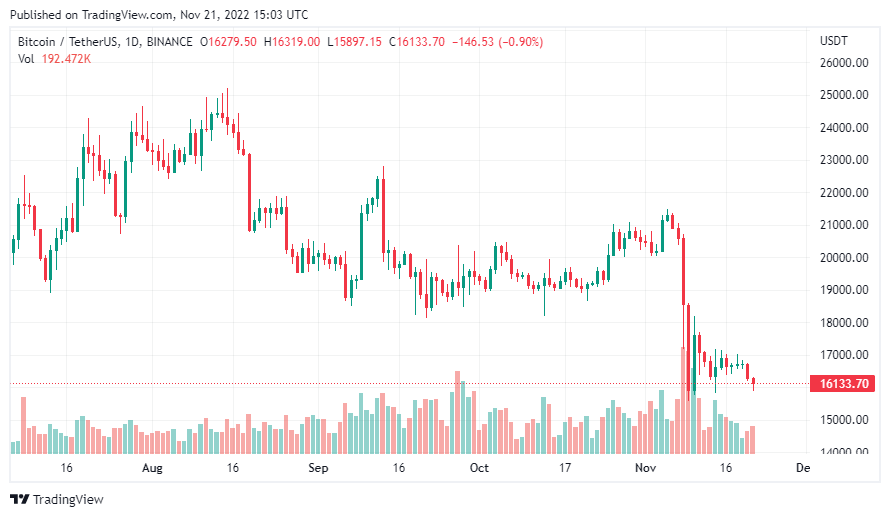

Bitcoin balances on over 24.7 million digital wallets were in loss positions on Monday as the leading cryptocurrency by market cap hovered just above $16,000.

The analysis report provided by IntoTheBlock tagged these addresses as “out-of-money addresses”. On-chain data showed that these wallets account for over 52% of all BTC holders. About 47 million addresses hole BTC, per IntoTheBlock’s research.

Indeed, BTC’s price declined from November 2021 highs following a pack of macro and crypto events. In addition to global inflation and tightening monetary policies in the U.S., market uncertainty triggered by the failures of stakeholders like Terra, Celsius, and most recently FTX supposedly contributed to slumped crypto prices.

BTC’s historical data also revealed that a similar dynamic occurred during previous bear cycles. In 2018 when Bitcoin dipped to XYZ, 55% of BTC balances sat out of money. On-chain metric recorded as high as 62% in 2015.

BTC mining startups have also felt the heat during this crypto winter where prices are down. Miners have increasingly offloaded their coins in a bid to generate costs and support business operations.

Reports emerged at the end of October 2022 that Core Scientific, a major BTC miner, might file for bankruptcy.

Bitcoin in loss ahead of the FOMC meeting minutes

At press time, BTC traded around $16,100 on Binance. The leading coin is over 60% from its $68,000 all-time high set back in November 2022. Also, the U.S. FOMC meeting minutes are scheduled for release on Wednesday.

Amid contagion from FTX and uncertainty regarding Grayscale’s parent company DCG, it’s unclear how BTC might react to the FOMC meeting.