Summary:

- A trader splurged almost $1 million buying Bitcoin Inscription #5232025 amid growing debates about congestion on the BTC network.

- This particular BTC Inscription holds 50,000 ORDI coins, the native asset of Ordinals Protocol which was created by developer Casey Rodarmor.

- ORDI was introduced earlier this year using the BRC-20 standard after developer Rodarmor designed a protocol for embedding digital data like art on every satoshi and pseudonymous builder Domo unveiled a token format akin to ERC-20 on Ethereum.

A trader spent 35 BTC buying Bitcoin Inscription #5232025 amid growing debates about congestion on the BTC network due to BRC-20 memecoins and a surge in text-based NFTs issued on crypto’s largest blockchain.

This particular BTC Inscription holds 50,000 ORDI coins, the native asset of Ordinals Protocol which was created by developer Casey Rodarmor.

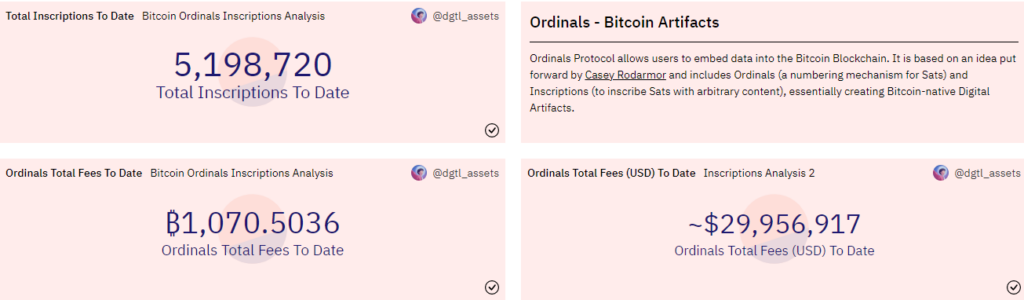

The scoop cost over $960,000 in Bitcoin at current market prices, possibly the highest sale for an Inscription since the asset debuted earlier in January 2023. Since then over 5 million inscriptions have been minted on Bitcoin’s blockchain, a surge that BTC purists claim has drastically congested the network.

Dune Analytics data showed that over 4 million of these Bitcoin Inscriptions are text-based. Less than half a million contain visual digital data in png format or what some might consider NFT art. These Inscriptions are made possible by using the Ordinals ProtocoL developed and launched by Casey Rodarmor.

Ordinals as they are commonly called by crypto participants have also racked up a fortune in fees. Users have spent over $29 million in fees experimenting with ordinals and attaching data to satoshi, the smallest unit of Bitcoin.

Average Fees Skyrocket On Bitcoin Inscription Activity

The rise of Ordinals and a token standard akin to ERC-20 on Ethereum seems to have sparked a tussle over block space on Bitcoin’s network. Indeed, the increased demand on BTC’s blockchain led to an uptick in transaction fees. Fees on BTC hit over $20 on average, a two-year high per on-chain data.

Rising average fees and a flood of BRC-20 tokens have formed a crescendo around arguments for and against ordinals. On one side, BTC bulls like Michael Saylor – whose company holds billions in Bitcoin – insist that Ordinals could serve as a “catalyst” for adoption.

BTC purists and some developers oppose the view, moving to sink NFTs and altcoins on BTC’s network.