Summary:

- Chainlink reserves on crypto exchanges have been in a state of constant decline since last year

- The CEO of CryptoQuant thinks that Chainlink is undervalued in terms of supply and demand

- Chainlink’s supply on exchanges will probably continue reducing as Grayscale continually scoops up LINK for its new trust

- Chainlink is currently attempting to turn the $30 price area into support

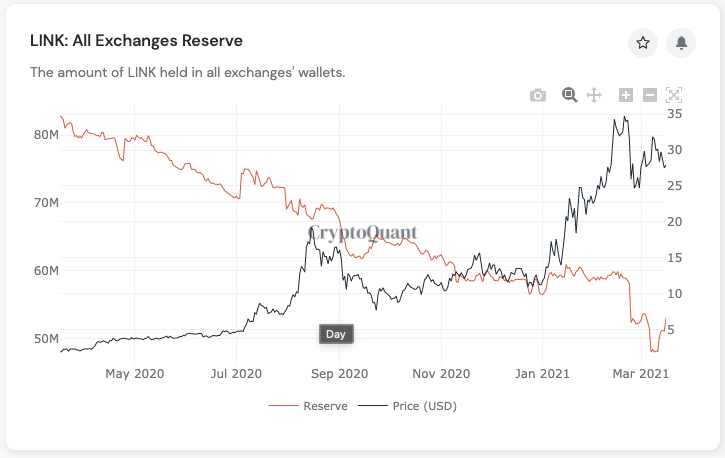

Chainlink (LINK) reserves on crypto exchanges have been in a state of constant decline for the last year. This is according to data provided by the CEO of CryptoQuant, Ki Young Ju, who also concluded that Chainlink might be undervalued in terms of supply and demand.

Mr. Ju shared his analysis of Chainlink through the following statement and accompanying chart.

I think $LINK is undervalued in terms of supply/demand.

(Disclaimer: I’m not a $LINK holder)

Accumulation of LINK by Grayscale Will Reduce Supply of LINK Further

From the chart shared, it can be seen that Chainlink investors have been religiously buying LINK and storing the digital asset offline thus reducing the available supply of the digital asset.

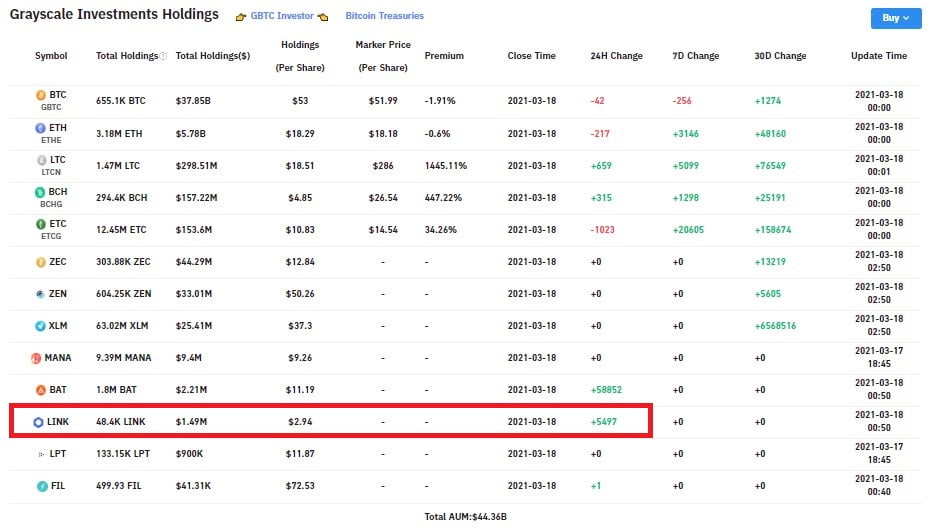

The supply of Chainlink will continue to reduce as a result of Grayscale launching its Chainlink Trust to provide individual and accredited investors exposure to LINK. A quick glance at Bybt.com reveals that Grayscale has already added 5,497 LINK to its bags in the last 24 hours and since the launch of the new trust.

The screenshot below courtesy of the tracking website further demonstrates this fact.

Chainlink Attempts to turn the $30 Price Area into Support

Chainlink Attempts to turn the $30 Price Area into Support

At the time of writing, Chainlink is trading at $29.50 in what looks like consolidation after yesterday’s positive reaction to news of Grayscale launching its LINK trust. When news hit the crypto-verse about Grayscale’s launch of a Chainlink trust, the value of LINK pumped by 15% from $27.26 to a local peak of $31.36.

If Chainlink manages to flip $30 into a support zone, coupled with Grayscale continually buying the digital asset, LINK could very well be on a path towards breaking the elusive $32 resistance that would mark a return to bullish territory for Chainlink.