- Binance CEO Changpeng Zhao warns about the “cascading effects” following FTX’s collapse on a recent conference in India as reported by Financial Times.

- CZ believes that the full impact of FTX’s meltdown tragic deteriation is yet to be felt in the crypto industry.

- FTX-associated platforms such as BlockFi have already started facing the heat, but Binance’s CZ warns others are also affected.

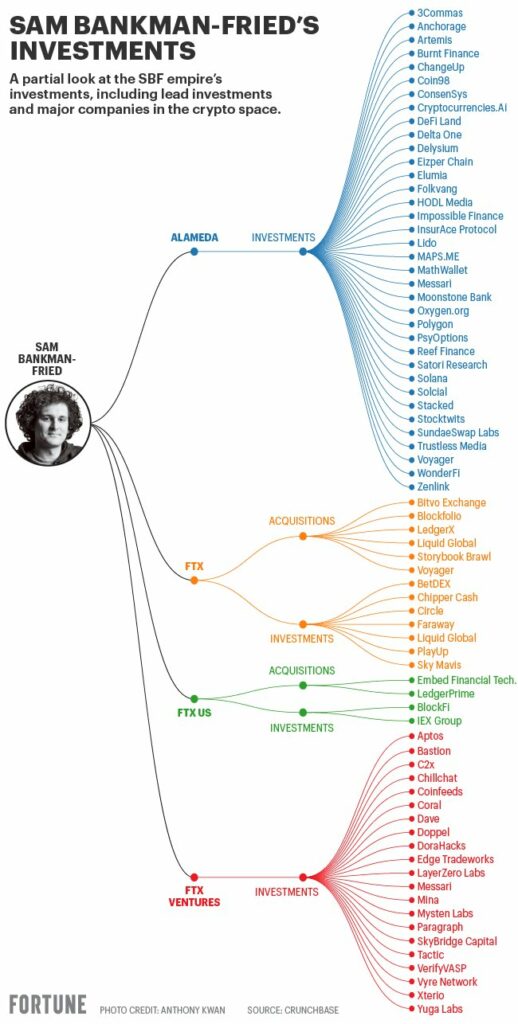

- Alameda’s bankruptcy threatens over 170 projects that it backed over the years.

- The fate of the firms acquired by FTX remains unknown.

FTX’s collapse will have cascading effects

According to a report by Financial Times, Changpeng Zhao has warned that several companies stand to fail in the near future as a direct consequence of the turmoil caused by the troubled crypto exchange FTX. While speaking at a conference in Indonesia, Zhao compared the current predicament of the crypto market to the Lehman moment in 2008’s financial crash.

Industry experts are viewing FTX’s collapse as the beginning of another contagion. Changpeng Zhao believes that the complete impact of FTX’s collapse is yet to be felt.

“With FTX going down, we will see cascading effects,” Changpeng Zhao said. “Especially for those close to the FTX ecosystem, they will be negatively affected,” he said.

The collateral damage

While the full impact may be yet to come, the industry is already seeing the effects of FTX’s collapse . Crypto lender BlockFi was bailed out by FTX in July following the crash of Terra. FTX had extended a $400 million credit facility, along with the possibility of an acquisition in the future.

BlockFi announced earlier today that it had suspended withdrawals on its platforms due to liquidity issues with FTX and Alameda. BlockFi was reportedly storing all of its customer deposits in FTX.

Voyager Digital is another platform that will have to face the consequences of SBF’s actions. The bankrupt crypto lender was set to receive $1.4 billion from FTX. This sale will likely be suspended, affecting thousands of Voyager customers.

Data from Crunchbase shows that FTX’s sister firm Alameda Research had spent millions of dollars to back over 170 projects. The fate of these projects, and those acquired by FTX including Bitvo, LedgerX, etc, is now uncertain.

Apart from the direct consequences, one has to consider what this will mean in terms of regulatory crackdown. Lawmakers are already calling for increased scrutiny and regulations. Regulators have started looking into the dealings of FTX. The first contagion gave the SEC an excuse to regulate by enforcement.