Summary:

- Coinbase said that the Binance-branded stablecoin BUSD does not meet the listing standards on the major crypto exchange.

- BUSD trading will be suspended on March 13, 2023, per an official tweet from the San Francisco-based company.

- “BUSD funds will remain accessible to you,” said the exchange as withdrawals will continue.

Coinbase will discontinue trading support for the Binance-branded stablecoin BUSD by 12pm ET on Mar. 13, 2023.

On Monday, the San Francisco-based crypto exchange said BUSD does not meet “our listing standards.” Also, BUSD trading will be suspended across a basket of product options including Coinbase.com (Simple and Advanced Trade), Coinbase Pro, Coinbase Exchange, and Coinbase Prime.

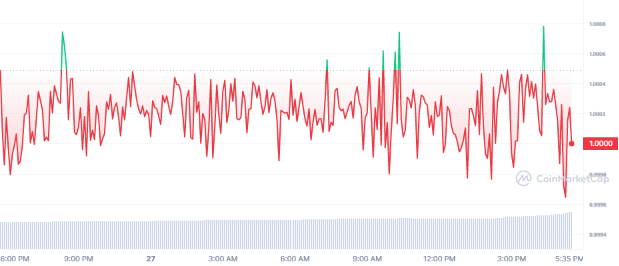

Binance’s BNB coin dipped slightly on the news to $302 while BUSD remained pegged to $1 despite the announcement. BUSD withdrawals will continue on the platform and users can access their balances until further notice. “….you will continue to have the ability to withdraw your funds at any time.”, said the crypto exchange.

Paxos Tussles With SEC AS Coinbase Shutters BUSD Trading

The news comes amid legal pressure from federal and state regulators on Paxos, a crypto trust company and the issuer of BUSD. Indeed, the U.S. Securities and Exchange Commission, under Gary Gensler, served Paxos a Wells notice.

Gensler’s commission accused the crypto trust co violating investor protection law. Paxos voiced disagreement with the notice and prepared to “litigate if necessary“. Paxos CEO Charles Cascarilla told employees that the crypto company was in constructive discussions with the SEC.

New York’s Department of Financial Services (NYDFS) ordered Paxos to cease minting or issuing new BUSD tokens. However, redemptions for BUSD’s $10.7 billion circulating supply will reportedly continue until at least February 2024.

Crypto’s third-largest stablecoin was the latest digital asset player on the SEC’s radar. Gensler’s commission also launched enforcement action against crypto exchange Kraken for its staking services. Kraken was fined $30 million and announced plans to shut down its staking business in the U.S.

The Kraken development emerged hours after Coinbase CEO Brian Armstrong tweeted that the SEC could crack down on crypto stakers currently servicing U.S. retail investors. Following the news, SEC Commissioner Hester Pierce AKA ‘crypto mom’ dissented from Gensler’s enforcement action.