- Coinbase is set to suspend trading of USDT, DAI, and RAI in Canada at the end of the month.

- The exchange stated that the decision was based on recent reviews and internal listing standards.

- Users will be able to deposit and withdraw the discontinued stablecoins following the suspension.

- Crypto.com withdrew support for USDT in Canada earlier this year at the direction of the local securities regulator.

Coinbase is set to suspend the trading of three popular stable assets in Canada, including the world’s largest stablecoin by market capitalization, Tether USD (USDT), at the end of this month. The other stablecoins include DAI and the Rai Reflex Index (RAI), a non-pegged Ether-backed stable asset commonly used on decentralized finance protocols.

Coinbase Will Allow Access To Suspended Stablecoins

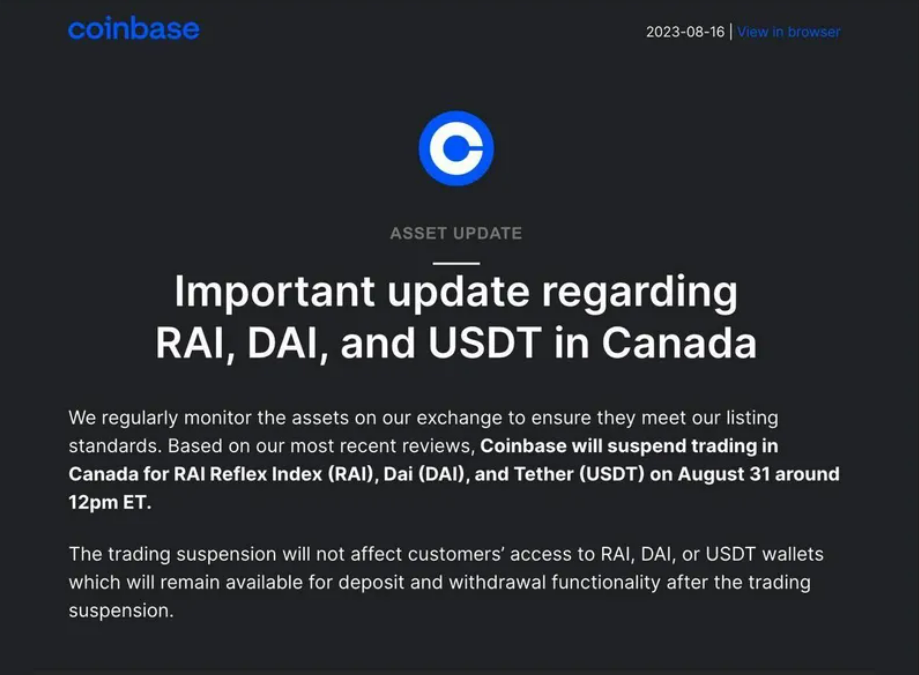

In an email to its users earlier today, Coinbase announced that it would suspend trading in Canada for USDT, DAI, and RAI on August 31, 2023. According to the crypto exchange, the decision was made based on recent reviews, which indicated that the stable assets did not meet the platform’s listing standards, which all assets are regularly monitored for.

Coinbase clarified that the trading suspension will not affect Canadian customers’ access to USDT, DAI, and RAI and that the users will be able to deposit and withdraw the stable assets from their wallets following the suspension. None of the stable assets had a considerable change in their prices following the announcement of the suspension.

Coinbase’s announcement comes less than a week after it officially launched its services in Canada’s crypto market. The move came after months of collaboration between the California-based crypto exchange and Canadian regulators and policymakers.

Earlier this year, fellow crypto exchange Crypto.com ended support for USDT after it was directed to do so by the Ontario Securities Commission (OSC). In December 2022, the Canadian Securities Administrators (CSA) stated that value-pegged crypto assets, including Tether, qualified as securities in the country.

Ironically, Tether withdrew support for Bitcoin Cash SLP, Omni Layer, and Kusama. The decision was reportedly part of a strategic transition based on the crypto industry’s demands.