Summary:

- The Ethereum network has seen a rise in daily active addresses

- Such an increment in network activity points towards Ethereum retesting $2k

- Ethereum balances on crypto exchanges continue to decrease

- Ethereum is probably being diverted to DeFi, NFTs, Cold Storage and ETH 2.0 Staking

- Only a weak Bitcoin will delay Ethereum from retesting $2k

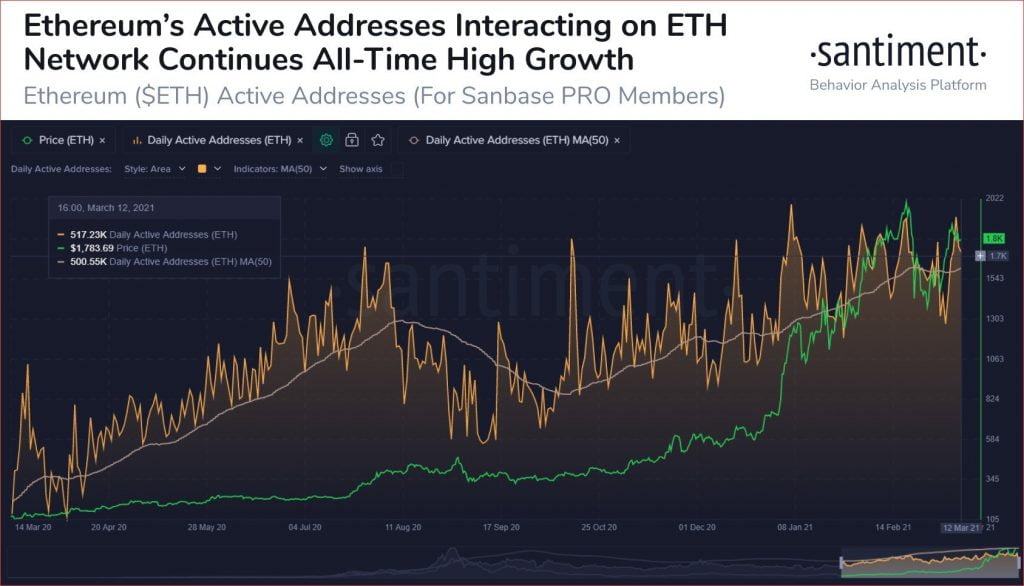

The Ethereum network has seen an uptick in daily active addresses. This is according to an observation made by the team at Santiment Feed who also pointed out that such a high level of network activity will increase the chances of Ethereum retesting $2k.

The team at Santiment shared their analysis of the Ethereum network through the following statement and accompanying chart.

To the surprise of few, Ethereum has been growing in utility. Currently just -7.1% off of its $2,030 All Time High three weeks ago, a continued rise in daily active addresses would imply a high likelihood of an inevitable retest of this historic mark.

Ethereum Balances Continue to Decline

Ethereum’s bullishness seen through an increased activity on the network through daily active addresses is further reinforced by a continuous decline in ETH balances on crypto exchanges. The decline of Ethereum on crypto exchanges was captured by the team at CryptoQuant as seen in the following tweet.

$ETH reserve across all centralized exchanges is decreasing, while $BTC reserve is repeating up and down since January this year.

Chart 👉 https://t.co/1bs87PnGJm pic.twitter.com/MG22PaIaFZ

— CryptoQuant.com (@cryptoquant_com) March 15, 2021

Ethereum is Being Diverted to DeFi, NFTs, Cold Storage and ETH 2.0 Staking

When trying to figure out where all the Ethereum out of crypto exchanges is headed, four scenarios come to mind.

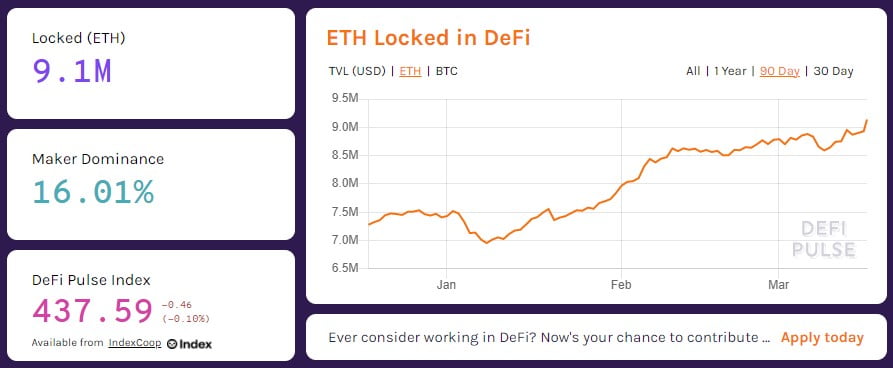

Firstly, Ethereum is headed to the various DeFi protocols where users continue to turn profits through yield farming and trading on the various Decentralized Exchanges. Evidence of this can be found in the 9.1 Million Ethereum currently locked in DeFi according to Defipulse.com (screenshot below).

Secondly, trade volume at NFT Marketplaces has increased rapidly in the last few weeks with DappRadar estimating that they have generated over $153 Million in transaction volume in the last 7 days alone. Furthermore, the majority of these marketplaces are live on the Ethereum network.

Thirdly, the Ethereum leaving exchanges is probably ending up in the cold storage of institutional investors such as Grayscale who are constantly scooping up ETH.

Fourthly, Ethereum investors are continually sending ETH to the ETH 2.0 deposit contract in anticipation of staking rewards.

Only a Weakening Bitcoin Will Delay Ethereum from Hitting $2k

At the time of writing, Ethereum is trading at $,1800. Therefore, with the aforementioned increased activity on the Ethereum network, ETH is on a trajectory towards retesting $2k.

However, ETH’s fate is very much linked to Bitcoin and the King of Crypto is currently exhibiting signs of weakness after falling from the $60k level to a local low of around $53,200. It is with this weakness that Bitcoin looks set to retest $52k or maybe $48k. If this scenario plays out, Ethereum’s journey to $2k might take a brief pause till market conditions improve.