Summary:

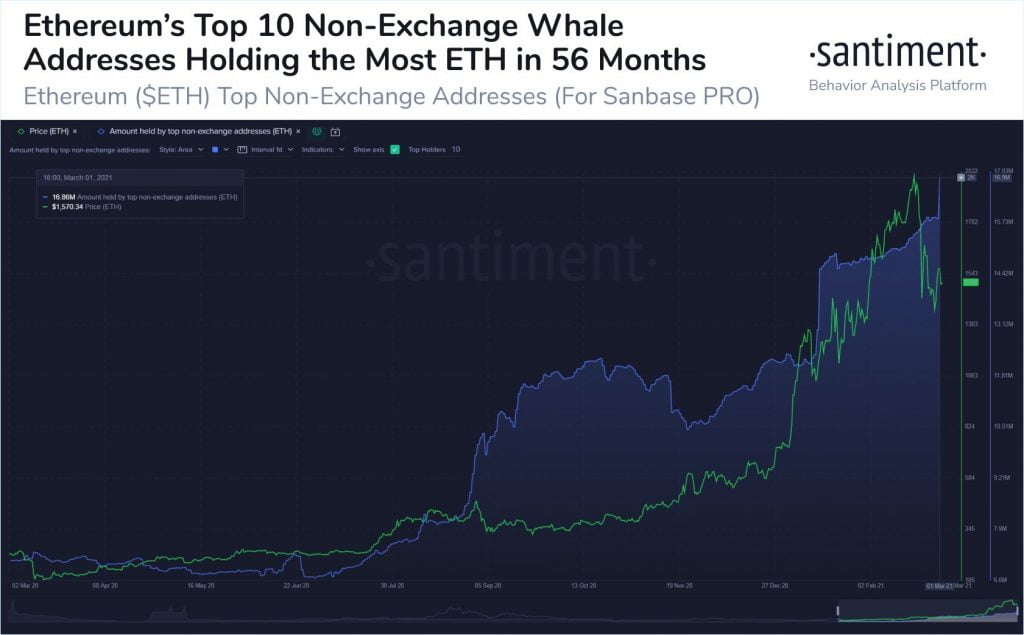

- Ethereum’s top 10 non-exchange whales accumulated 1.03 million ETH in a single day

- This is the highest one-day accumulation in 6 weeks

- The Ethereum whales now own a combined 16.86 million ETH

- Ethereum’s price is currently being affected by uncertain global markets

On the 1st of March, Ethereum’s top 10 non-exchange whale addresses accumulated 1.03 million ETH in a 24 hour period. This amount that is roughly valued at $1.6 billion, is the highest one-day jump in the accumulation of ETH in 6 weeks.

The team at Santiment was the first to identify this event and also added that the same top 10 whale addresses now hold approximately 16.86 million ETH. The team shared their observation via the statement below and accompanying chart.

#Ethereum‘s top 10 non-exchange whale addresses are now holding the most combined supply of $ETH tokens (16.86M) since July, 2016. on March 1, a single-day addition of 1.03M tokens was added among these addresses, the highest one-day jump in 6 weeks!

Top 10 Non-Exchange Whales Hold 14.6% of ETH’s Circulating Supply

Doing the math, Ethereum’s top 10 non-exchange whales hold approximately 14.6% of ETH’s circulating supply of 114.9 million (according to Coinmarketcap). Furthermore, the whales’ stash of Ethereum is valued at a whopping $26.3 billion using Ethereum’s current value of $1,560.

Such an accumulation is proof that Ethereum’s large investors continue to play the long game with ETH. This is despite the emergence of gas-friendly blockchains such as the Binance Smart Chain, Zilliqa, Tron and Cardano.

Ethereum Maintains $1,500 Amidst a Weakening Bitcoin

With respect to price, Etheruem’s $1,500 support continues to hold as Bitcoin and the rest of the crypto markets continue being hit hard by the uncertainty related to the global stock markets. This in turn means that the fate of Ethereum is very much tied to the global events that govern the traditional world of investing.

Therefore, Ethereum traders are advised to not only watch Bitcoin, but indices such as the S&P 500 (SPX) and the Nasdaq (IXIC), when considering an ETH trade in the days to follow.