Quick take:

- Grayscale Investments has quietly scooped up 178,691 Litecoin in the last 30 days

- This translates to roughly $28.9 million in Litecoin

- Gene Simmons has openly declared that he is ‘a happy Litecoin investor’

- The 50 day MA provides LTC with support at current levels of $160

- The monthly close tonight could send the value lower to the $150 – $145 price area

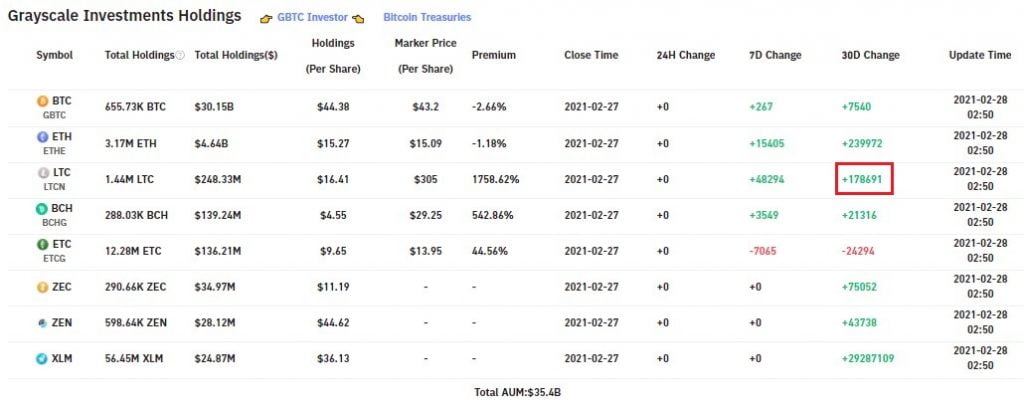

The Wall Street investment firm of Grayscale has quietly accumulated 178,691 Litecoin in the last 30 days. This amount of LTC has a value of roughly $28.9 Million using Litecoin’s current price of $162. The 30-day accumulation of Litecoin by Grayscale has been highlighted in the following screenshot courtesy of Bybt.com.

I’m Also a Happy Investor in Litecoin – Gene Simmons

The accumulation of Litecoin is not isolated to institutions such as Grayscale. Earlier this week, the frontman of the popular band known as Kiss, Gene Simmons, took to Twitter to announce that he was ‘a happy investor in Litecoin’. Mr. Simmons went on to recommend that investors do their own research on LTC as seen through the following tweet.

I’m also a happy investor in Litecoin. Do your own research…What is Litecoin? – LTC Beginners Guide https://t.co/7LB34WKa5U via @YouTube

— Gene Simmons (@genesimmons) February 21, 2021

Litecoin Could Be Headed Lower With the Weekly/Monthly Close

A quick glance at the charts reveals that Litecoin has also been hard hit by the ongoing crypto market selloff that has seen Bitcoin retest the $44k price area. At the time of writing, Litecoin is trading at $162 which also happens to be a crucial support area as seen in the following daily LTC/USDT chart.

The above LTC/USDT chart also provides the following information on Litecoin’s possible price action into the new month of March.

- The 50-day moving average provides support at current levels of $160

- The daily MACD, MFI and RSI point towards an ongoing correction for Litecoin

- Trade volume is in the red with the daily Heiken Ashi candles also in the red, thus confirming continual selling

- The $150 – $145 price area is the next support zone should the current one be broken

- The 100-day and 200-day MA’s provide macro support areas at $140 and $95 respectively

- Chances are that volatility downwards will increase with the weekly/monthly close later today