Summary:

- The opening brief by Grayscale in a lawsuit against the U.S. Securities and Exchange Commission called the regulator’s decision “capricious” and “discriminatory”.

- Gary Gensler’s federal agency rejected the digital asset manager’s application to convert its $12 billion Bitcoin spot trust into a Bitcoin exchange-traded fund.

- The switch in fund structure could help stem the rising GBTC discount, returning the fund’s BTC offering to “net asset value”.

- The SEC cited fraud risks and market manipulation as the primary reasons for the decision.

A lawsuit has been launched by Grayscale Investments LLC against the U.S. Securities and Exchange Commission over the regulator’s decision to reject a Bitcoin exchange-traded fund (ETF) application.

Grayscale, the largest digital asset manager at press time, submitted a bid to convert its $12 billion Bitcoin (BTC) spot trust to an ETF. The asset manager launched its GBTC offering in 2013 and applied to restructure the fund in October 2021.

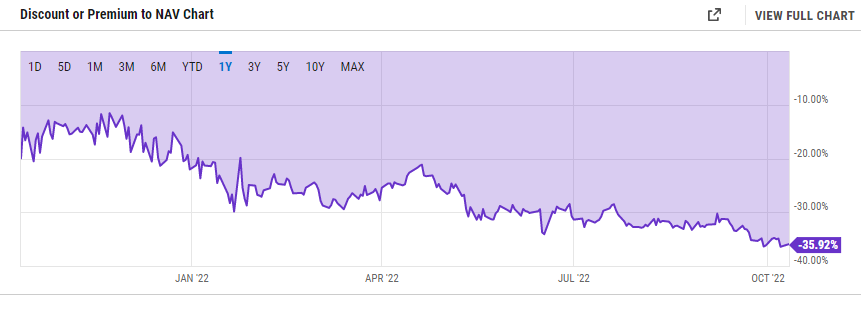

Notably, the GBTC discount has grown significantly and hit a record 36.2% in September. The switch from a BTC spot trust to a Bitcoin spot ETF could slash the Grayscale discount. A reduced discount would bring the offering closer to net asset value, per reports.

Spot And Futures-based ETFs Face The Same Risks – Grayscale

The opening brief in the lawsuit against the SEC notes that the regulator has arbitrarily approached applications for futures and spot-based ETFs despite both offerings facing identical risks.

SEC rhetoric regarding Grayscale’s ETF has insisted that fraud risks and market manipulation concerns are the main reasons why the regulator has rejected the firm’s application. The firm argued that the SEC’s logic is contradictory and “unfair”.

The Commission Arbitrarily Determined That the Proposed Rule Change Was Not Designed To Prevent Fraud and Manipulation, Even Though the Bitcoin Futures ETPs That the Commission Has Approved Are Exposed to Exactly the Same Risks of Fraud and Manipulation as the Trust’s Proposed Spot Bitcoin ETP.

CEO Michael Sonnenshein said back earlier in the year that legal action against the U.S. regulator was under consideration should the SEC reject his firm’s ETF application. The company has also called on American-based investors to push for a BTC ETF.