Summary:

- Hobit users were told to withdraw all assets from the crypto exchange by Wednesday, June 21 before 4 PM UTC.

- The platform will shutter all centralized exchange or CEX operations today May 22 by 4 PM UTC amid declining exchange trading activity and months after a criminal investigation into a former Hotbit manager.

- Hotbit also cited stifled cash flow due to a U.S. banking crisis and the after-effects of FTX’s crash last November as reasons for its decisions.

Amid declining crypto exchange trading volumes and on/off ramp difficulties, one CEX player is leaving the game for good.

Hotbit, a crypto exchange operating out of Shanghai and Taipai with 5 million users, announced the shutdown of all CEX operations starting today May 22. Users will have until 4 PM UTC on June 21 to withdraw all assets from the platform.

For 5 years and 4 months, the Hotbit team has been proud to participate in a wonderful crypto show with 5 million users. However, it is with great regret that we have made the decision to stop all CEX operations from May 22, UTC 04:00.

Hotbit Bows Out

The decision comes nine months after a criminal investigation into a former employee, one of the reasons Hotbit has decided to sunset its centralized crypto exchange business. Although the nature of alleged crimes committed by the former manager was never explicitly revealed, other employees were subpoenaed and cooperated with the probe, reports said.

Shortly after this, the collapse of FTX and a U.S. bank crisis – which caused Circle’s USDC stablecoin to de-peg – crippled on/off ramp options, making cash harder to access for Hotbit and drained the platform’s cash reserves.

Hotbit said its team believes the CEX model that supports a dearth of assets “is unsustainable from a risk management standpoint”. The platform cited several losses stemming from cyber attacks, malicious users, and defective codes deployed by projects.

After navigating these turbulent waters, the platform also believes that operating a large CEX is increasingly difficult. The exchange also noted that the CEX industry has veered towards a crossroads where players must either become more centralized or embrace regulations.

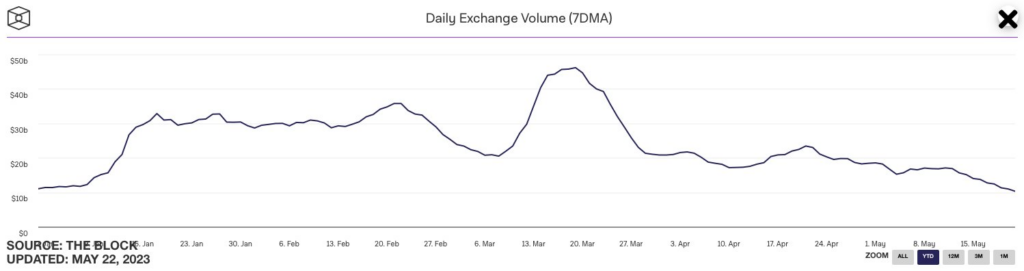

While the platform’s sunset is set in stone now, other crypto exchanges are navigating declining trading volumes and regulatory uncertainty in jurisdictions like America. Daily CEX volume dropped to $10.4 billion on May 21, its lowest level so far in 2023.

Stakeholders like Coinbase are also expanding their products and setting their eyes on new shores in a bid to strengthen their books and survive market conditions.