- Bitcoin is trading at the lower boundary of the stock-to-flow model by PlanB

- Bitcoin has traded at this lower boundary before as was the case in March 2020

- According to PlanB, his model could be invalidated if Bitcoin remains in the $30k range for a couple more months

- Time will tell whether the current Bitcoin environment leads to an invalidation of the model

- The S2F has been an invaluable tool since it was released in 2019

Bitcoin’s stock-to-flow model is once again on the minds of multiple crypto analysts and traders as BTC continues to trade at the lower boundaries of the model.

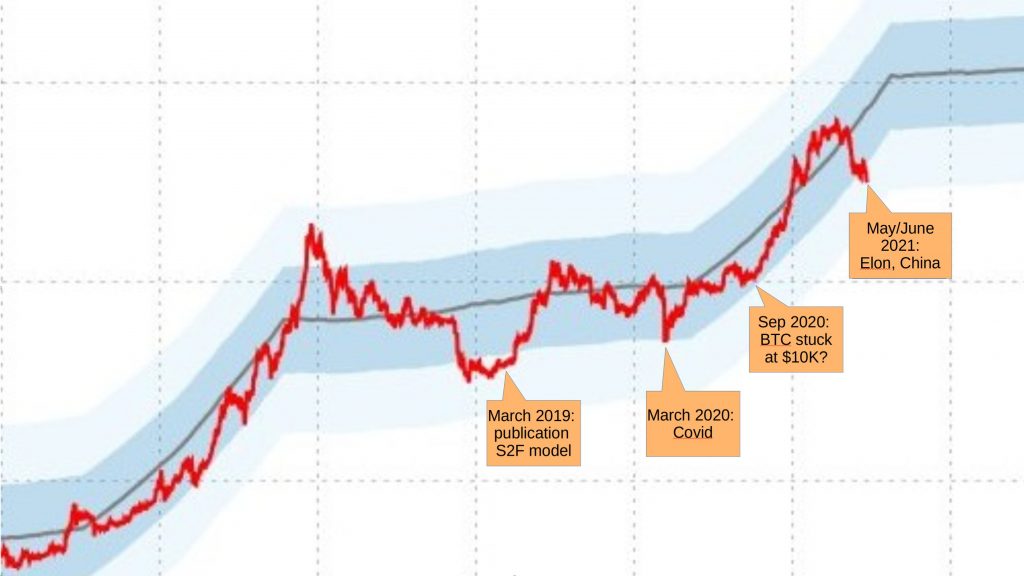

In a Twitter commentary earlier today, the creator of the model, PlanB, pointed out that this was not the first time Bitcoin has tested the lower boundaries of the Stock-to-flow model. He explained that Bitcoin traded in this area during the Coronavirus crash of March 2020 and went on to post new all-time highs.

His exact statement can be found below alongside a chart demonstrating Bitcoin’s current position in his stock-to-flow model.

Even for me it is always a bit uneasy when bitcoin price is at the lower bound of the stock-to-flow model. Will it hold (like Mar 2019 when I published S2F, or Mar 2020 Covid, or Sep 2020 with BTC stuck at $10K) and is this another buying opportunity? Or will S2F be invalidated?

S2F Could be Invalidated if Bitcoin Stays in the $30k Range for a Couple More Months

In response to another Tweet pointing out that the stock-to-flow is already invalidated, PlanB stated that it was yet to be so. According to PlanB, the model was still valid but could be invalidated if Bitcoin continued to trade in the $30k price range for a couple more months. A screenshot of the Twitter conversation can be found below.

All Models Have Estimation Error and are Simplifications of Reality – PlanB

PlanB also highlighted that all models are prone to failure if there are enough factors to warrant a deviation. He explained:

True. All models are imperfect/wrong and have deviation/estimation error, because models are simplifications of reality. Admittedly S2F deviations can be very large, because S2F model only has 1 input variable (S2F ratio) and there are hundreds of other factors that impact price.

PlanB’s Bitcoin Stock-to-flow Model Has Been Accurate Thus Far

Summing it up, PlanB’s Bitcoin stock-to-flow model is once again being tested by the bearish crypto environment brought about by Tesla halting BTC payments for vehicles and China banning BTC mining within its territories.

As a result, only time will tell whether Bitcoin enters into a bear market thus invalidating the stock-to-flow model that has been accurate at predicting BTC’s price movements since it was first published in March 2019.

Whether it gets invalidated or not, the stock-to-flow model has been a useful tool for many including the CEO of Pantera Capital who has cited it on numerous occasions.