Quick take:

- Bitcoin’s Twitter sentiment has taken a nosedive in the month of March

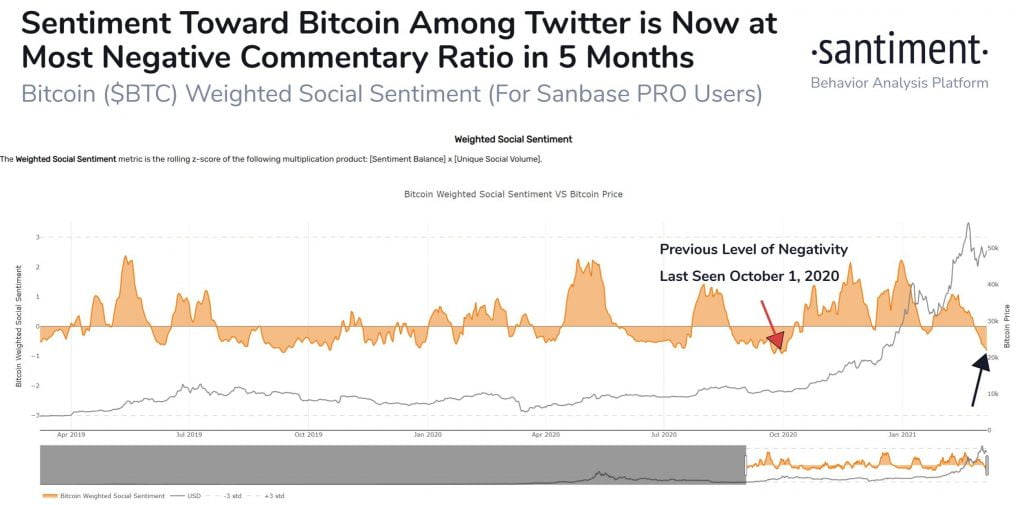

- BTC Twitter sentiment is at its most bearish since October 1st 2020

- However, the approval of a $1.9T stimulus bill might change the tide for Bitcoin

- Bitcoin has regained the crucial $50k support with the weekly close ahead

- Bitcoin reclaiming $52k and $55k would return it to bullish territory

Twitter sentiment surrounding Bitcoin has dropped to levels last seen in early October last year. This is according to an observation made by the team at Santiment who also reminded investors that periods of fear and extreme bearishness, are usually the best time to buy back into Bitcoin. Below is their observation of Bitcoin’s Twitter sentiment alongside a chart demonstrating how low it has dropped this month.

In spite of #Bitcoin hovering from $46.5k to $52.5k this past week, the sentiment from #Twitter is at its most bearish level since October 1, 2020 today. As we’ve noted in previous studies, moments of crowd disbelief are commonly the most opportune times to buy with confidence.

$1.9T Stimulus Bill is an Advertisement for Bitcoin – Tyler Winklevoss

To note is that Bitcoin was trading at $10k around October 1st, and would go on to close 2020 at roughly $28k thus giving weight to the notion that BTC is gearing up for another drive up.

The idea that now is an opportune time at getting back into Bitcoin is further boosted by the fact that the US Senate approved a $1.9 Trillion stimulus bill that would see individuals get $1,400 checks to cushion them against the financial effects of COVID19.

The Co-Founder and CEO of the Gemini Exchange, Tyler Winklevoss, was quick to describe the new stimulus bill as a $1.9 Trillion dollar advertisement for Bitcoin as seen in the tweet below.

$1.9 trillion dollar advertisement for #bitcoin was just approved by the Senate https://t.co/dx7z0Ycgaf

— Tyler Winklevoss (@tyler) March 6, 2021

Bitcoin Regains $50k, Setting its Eyes on $52k and $55k

What Tyler Winklevoss was referring to is that the $1.9 Trillion will be freshly printed by the Federal Reserve. This means that the US dollar will potentially lose value and Bitcoin is the perfect hedge against the incoming inflation.

Additionally, chances are that part or all of the $1,400 stimulus checks disbursed to individuals, will be used to buy digital assets with bitcoin being top on the list.

At the time of writing, Bitcoin is trading at $50k with the weekly close only a few hours away. If this level can be maintained through the crucial weekly close event, Bitcoin will most likely conquer $52k and $55k in the next few days thus reigniting its bullish momentum.