In brief:

- Social media discussions surrounding Chainlink have been dormant since mid-February

- This might be a good thing as digital assets usually rise in price when there is no crowd excitement

- However, Chainlink’s active addresses are declining alongside deposits to crypto exchanges

- The number of Chainlink whales with 10k LINK or more has also been on the decline

- Chainlink is currently battling to maintain the $25 price area

The digital asset of Chainlink is currently undergoing a dormant phase in terms of social media discussions. This is according to data by the team at Santiment who also pointed out that such dormancy can actually be a good thing for the price of LINK as explained below.

LINK is not having a major amount of discussion, and this is actually a good thing. Our studies prove that assets are more likely to rise when crowd discussion is dormant.

Chainlink Active Addresses are on the Decline

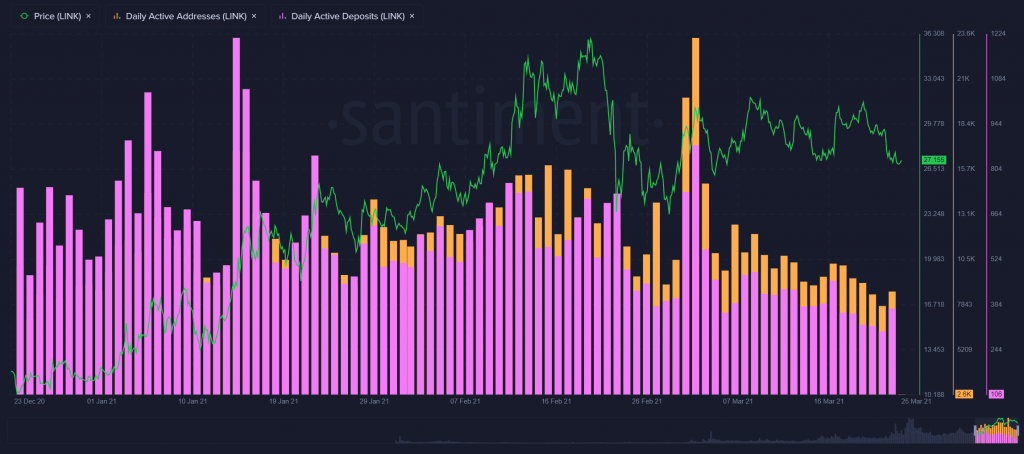

At the same time, the address activity on the Chainlink network has been declining since early March. A drop in network activity could be the first sign of possible trouble for Chainlink in the crypto markets as it means there is a reduced demand for LINK on the network.

The chart below, courtesy of Santiment, further illustrates the drop in daily active address activity since the month began.

Chainlink Whales Holding 10k+ LINK on the Decline

On-chain data from the team at Santiment also highlighted a drop in the number of Chainlink whales holding at least 10k LINK. Such a drop is also concerning as it points towards continual selling of LINK by the large Chainlink holders.

LINK Battles to Retain the $25 Support

At the time of writing, Chainlink (LINK) is trading at $25.80 after a quick drop to a local low of $23.60 earlier today.

The latter price area was the result of a crypto-wide meltdown that also saw Bitcoin drop from yesterday’s high of $57,100 to a local low of $50,400.

To note is that plenty of quarterly Bitcoin options and futures expire tomorrow, March 26th, and the event could come with additional selling pressure for BTC. The possibility of additional selling could ultimately result in Chainlink once again battling to retain the $25 price area.