- Ethereum percent addresses still in profit has hit a 5-month low of 90.73%

- The number of Ethereum addresses in loss has also hit a 5-month high of 5.542 million

- Ethereum miner revenue has also reached a 3-month low of $1.121 Million

- 187k ETH has been sent to crypto exchanges in the last week and could be the onset of capitulation

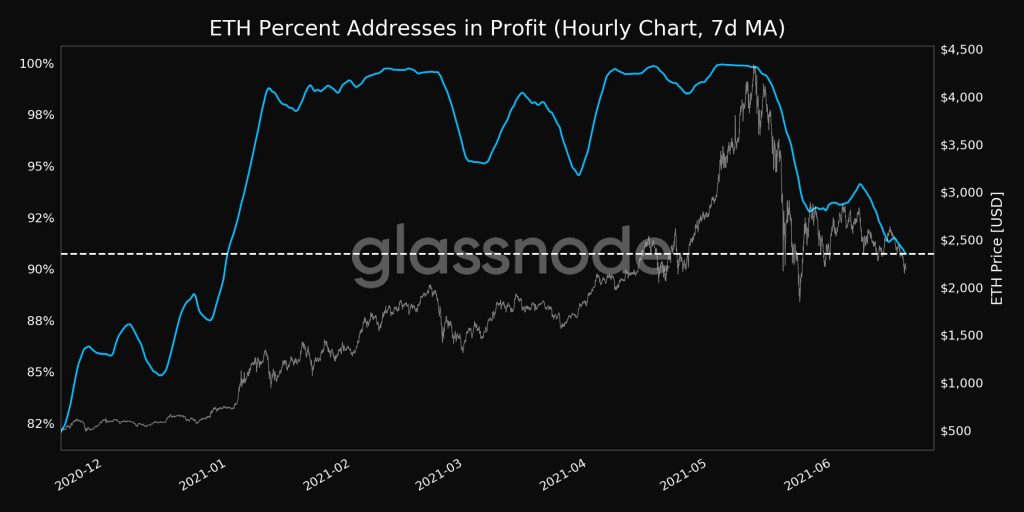

The percent of Ethereum addresses still in profit has hit a 5-month low of 90.73%. This is according to an analysis by the team at Glassnode who also provided the following chart to demonstrate the drop in the number of Ethereum addresses still in profit.

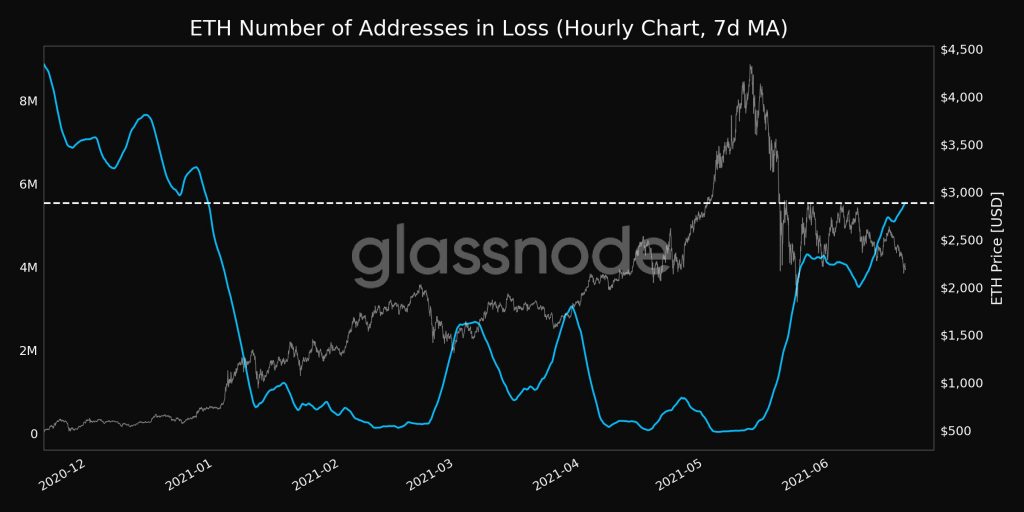

Ethereum Addresses in Loss Hits a 5-month High of 5.542 Million

In a similar analysis, the team at Glassnode pointed out that the number of Ethereum addresses in loss has hit a 5-month high of 5,542 million. The team further provided the following chart demonstrating the increased number of Ethereum addresses in loss due to ETH dropping to current levels around $2,200.

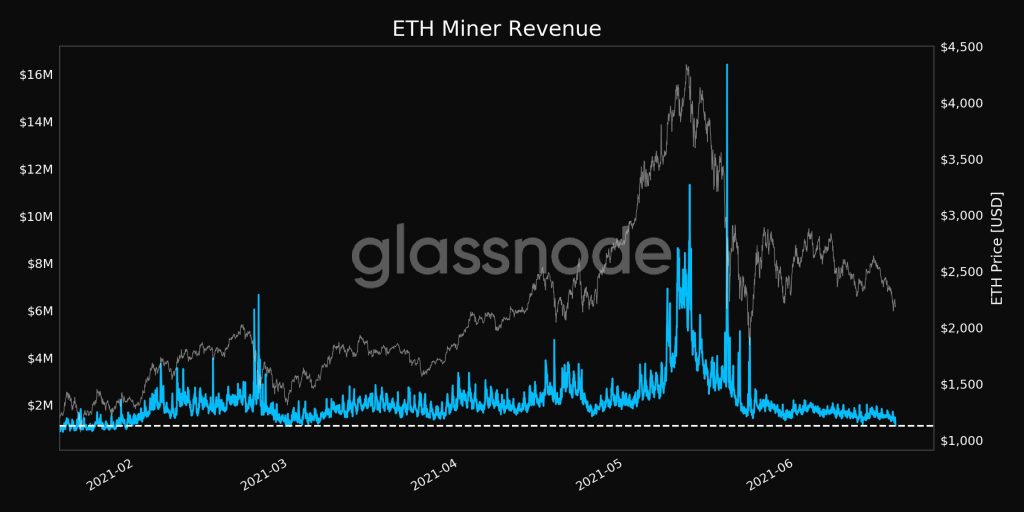

Ethereum Miner Revenue Hits a 3-Month Low of $1.121 Million

In an additional analysis, the Glassnode team also pointed out that Ethereum miner revenue has also hit a 3-month low of $1.121 million as demonstrated in the following chart.

Ethereum Investors Deposit 187k ETH to Crypto Exchanges in the Last Week

In terms of Ethereum flows in and out of exchanges, investors have deposited a total of 187k ETH into these platforms in the last seven days as highlighted in the following screenshot courtesy of Viewbase.com.

Is Capitulation on the Horizon for Ethereum?

In an earlier analysis, it was pointed out that Ethereum could be gearing up for a retest of $1,800 due to Bitcoin continually asserting its dominance in the markets.

An increased Bitcoin dominance, coupled with the metrics pointed above, points towards an ongoing pullback for Ethereum that could ultimately lead to capitulation by ETH investors if the general market environment gets worse.