- Ethereum could be on track to surpass Bitcoin in terms of market cap

- Ethereum’s market cap is currently half of Bitcoin’s

- Ethereum will thrive due to continual use-case such as DeFi

- Ethereum should consolidate for a while between $2k and $4k

The team at Bloomberg has released their monthly Crypto Outlook Report in which they point out that Ethereum is on track towards surpassing Bitcoin in terms of market capitalization.

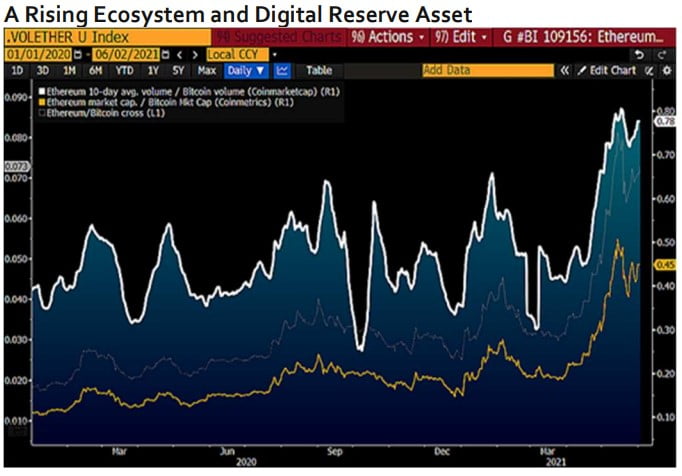

According to their research, Ethereum’s journey towards eclipsing BTC is hinged upon the various use-cases of the network such as Defi, and the role the native digital asset of ETH plays in the ecosystem. The report goes on to highlight that Ethereum has been continually gaining market share against Bitcoin and its market cap is now half of BTC. This fact was explained by the team through the following statement and accompanying chart.

…the foundation and use case of [Ethereum] is a strong complement to the more macro store-of-value attributes of [Bitcoin]. Our graphic [below] depicts volume as a leading indicator for advancing Ethereum (ETH), which has attained the 50% mark vs. Bitcoin in terms of market cap. ETH’s 10-day average trading volume from Coinmarketcap has about doubled toward 80% of Bitcoin’s from the start of 2021.

Ethereum To Consolidate for a While Between $2k and $4k

Ethereum To Consolidate for a While Between $2k and $4k

With respect to price action, the Bloomberg team labeled ETH’s $2k to $4k price zone as being a ‘sweet spot’ and where Ethereum will be consolidating for a while.

According to their analysis, the recent dip below $2k flushed out the majority of the speculation surrounding ETH. As a result, Ethereum’s current price can be considered as being at a discount given that the network is the ‘go-to platform for cryptos and decentralized finance’.

The Ethereum network has more or less won the adoption race. Therefore, the number two digital asset will most likely continue on an upward trajectory with $2k acting as good support and $4k being a reasonable resistance moving forward.