- Ethereum whales holding 1k to 10k ETH are still holding their coins

- The Ethereum whales started accumulating ETH in October 2020

- Ethereum’s daily address activity is on the decline which is bearish

- Trader sentiment towards Ethereum continues to be negative and could lead to a capitulation event

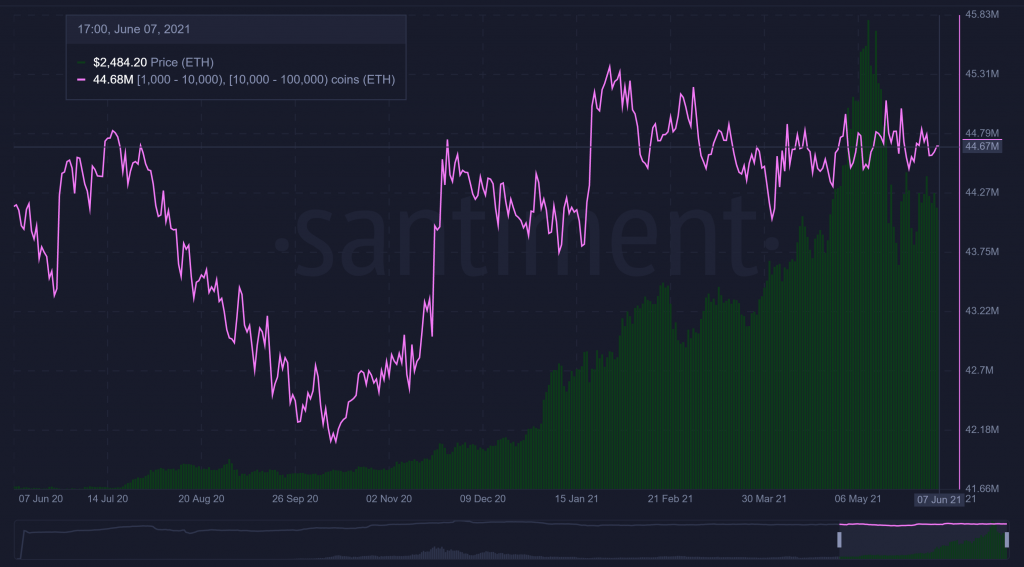

Ethereum whales holding 1,000 to 10,000 ETH are still holding onto their coins despite the ongoing stagnation of the digital asset below the $2,800 resistance level. This is according to a report shared by the team at Santiment which also pointed out that the same whales have been accumulating their bags of ETH since last October, and are not ‘budging much during this ranging period in the mid $2,000 price level.’

The commitment of Ethereum whales to keep holding has been visualized in the following chart from the report.

Ethereum Address Activity on the Decline

The team at Santiment went on to point out that the address activity on the Ethereum network has been on a decline since posting an all-time high in mid-May. They added that such a drop in address activity is a bearish sign for Ethereum in the crypto markets since it affects demand for ETH.

Ethereum Sentiment Being Negative Could Cause a Capitulation Event

The bearish cloud hanging over Ethereum is best exemplified by trader sentiment that continues to lie in negative territory. According to the Santiment report, Ethereum’s sentiment staying in negative territory is also a bearish sign as explained below.

Ethereum’s negative social sentiment is dipping down to levels that haven’t been seen since October, 2020. This crowd doubt is extremely indicative of a capitulation event if it lasts for too much longer.

Ethereum Holders Waiting on Bitcoin to Make a Move

With respect to price action, the report concluded that Ethereum traders and investors are staying put as they watch Bitcoin’s next major move in the crypto markets. The same investors continue withdrawing their Ethereum out of centralized crypto exchanges and into DeFi or personal wallets.