Summary:

- Another crypto firm announced changes to operations due to FTX’s contagion.

- The lending department of Genesis Global Trading “temporarily suspended” customer withdrawals and new loan originations on Wednesday, CoinDesk reported.

- Interim CEO Cerar Islim delivered the update during a client call.

- The operational change did not affect Genesis Trading, the company’s trading division that had exposure to Three Arrows Capital.

Withdrawals on Genesis Global Capital were paused on Wednesday following exposure to Sam Bankman-Fried’s crypto exchange FTX, CoinDesk reported. Interim CEO Cerar Islim first shared the development over a client call on Wednesday. Islim further noted that new loan originations were halted along with withdrawals.

The firm’s parent company Digital Currency Group (DCG) also shared a statement, saying the “decision was made in response to the extreme market dislocation and loss of industry confidence caused by the FTX implosion”.

DCG also oversees firms like CoinDesk, Foundry, Grayscale, and Luno. After Terra’s $40 billion implosion, Genesis under Michael Moro at the time filed a $1.2 billion claim against Su Zhu’s crypto hedge fund Three Arrows Capital (3AC).

Turbulence with the crypto lender could herald a massive fallout in the crypto industry. Along with damage from FTX’s alleged fraud, Genesis was the biggest lending desk before Terra wiped out $40 billion from the market.

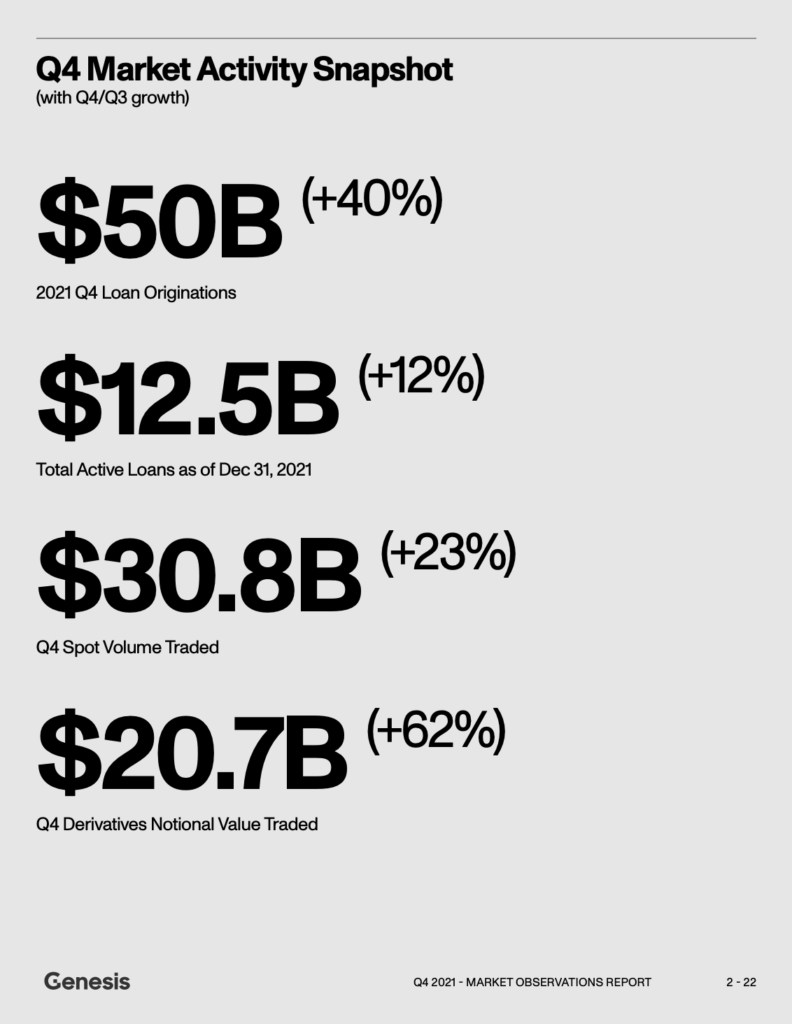

Indeed, what started as the first over-the-counter (OTC) Bitcoin trading desk in 2013 closed out 2021 with around $12.5 billion in active loans and derivatives volume worth $21 billion, per a Q4 Market Activity Snapshot.

Amanda Cowie, VP of communications and marketing at DCG said that the company’s custody and trading outfits remain unaffected by the decision. The company’s derivatives arm reportedly held around $175 million worth of crypto assets on FTX before the exchange froze customer withdrawals.

Gemini Earn Program In Trouble After Genesis Halts Withdrawals

Customers of Gemini’s Earn program were also affected by the news. According to a blog post, the crypto exchange will not meet its redemption service-level-agreement period of five days. The platform founded by the Winklevoss twins tapped Genesis as a lending partner.

We are disappointed that the Earn program SLA will not be met, but we are encouraged by Genesis’ and its parent company Digital Currency Group’s commitment to doing everything in their power to fulfill their obligations to customers under the Earn program.

FTX contagion continues to attack firms and cripple operations throughout crypto’s ecosystem. Cerar Islim’s appointment as interim Genesis CEO came after former Michael Moro stepped down. Moro resigned following billions in exposure to Three Arrows Capital, a crypto hedge fund founded by Su Zhu and Kyle Davies.

3AC collapsed after Terra’s contagion spread fear through the market. In a somewhat similar manner, the FTX debacle has seemingly triggered a domino effect in the digital asset community.

Bankman-Fried’s company has filed for bankruptcy in New York and Delaware at press time. Several U.S. Federal agencies like SEC and Justice Department also launched probes into SBF’s empire/