- Institutional demand for GBTC and QBTC has dropped

- The premium on both Bitcoin products has been in negative territory since March

- The trade volume of GBTC and QBTC has also been reducing since the beginning of the year

- Grayscale has not purchased additional Bitcoin since February and 3iQ has reduced its Bitcoin holdings by 7.98k this month

Institutional demand for the Grayscale Bitcoin Trust (GBTC) and 3iQ’s Bitcoin Fund (QBTC) has been on the decline for the better part of the year. This is according to an analysis shared by the team at CryptoQuant that pointed out the following 3 key metrics highlighting the decline in demand.

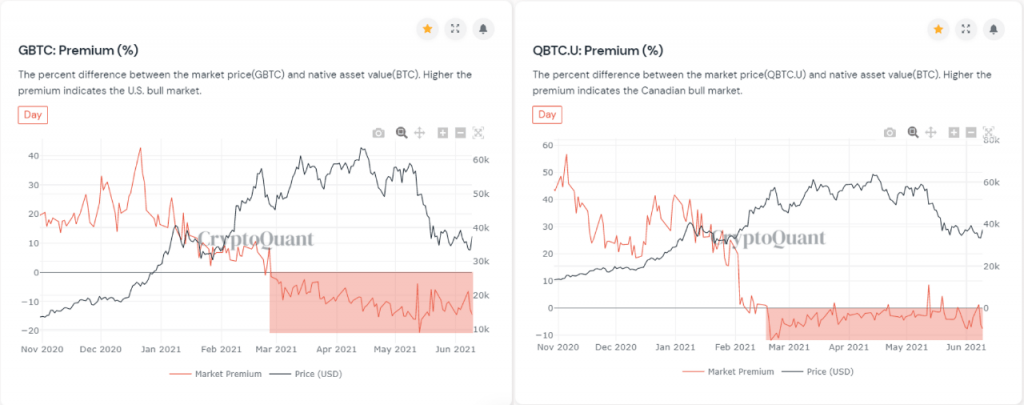

Premium on GBTC and QBTC Has Been Negative since March

To begin with, the trading premiums on the Grayscale Bitcoin Trust (GBTC) and 3iQ’s Bitcoin Fund (QBTC) have been in negative territory since early March. The chart below, courtesy of CryptoQuant, further demonstrates this fact.

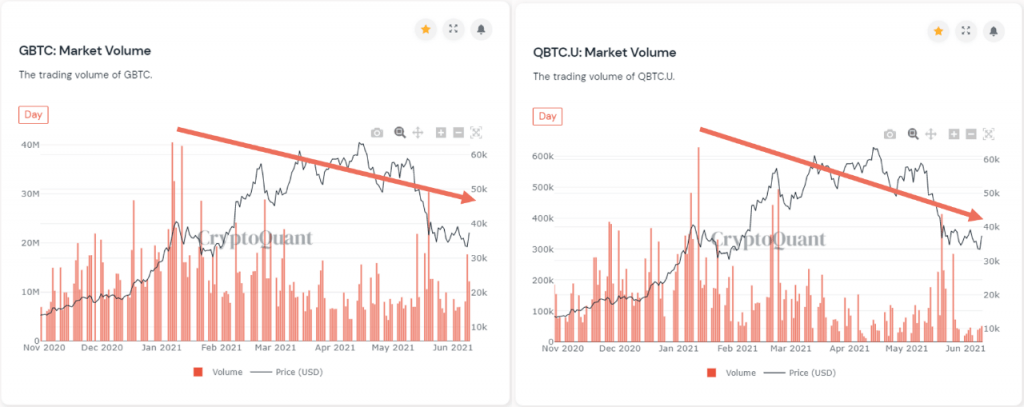

Trade Volume of GBTC and QBTC Has Been On the Decline in 2021

Secondly, the market volume of both the GBTC and QBTC has been on the decline since January as highlighted in the following chart.

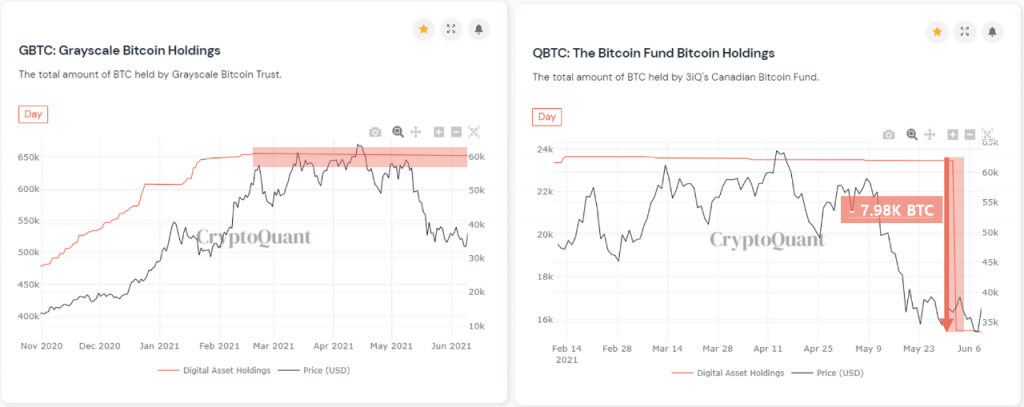

Grayscale Has Not Added Any BTC, 3iQ has reduced its Holdings By 7.98k BTC

Thirdly, the analysis by CryptoQuant pointed out that Grayscale has not added any Bitcoin to its trust since its last purchase in February this year. Additionally, 3iQ has reduced the Bitcoin holdings of its fund by 7,980 BTC this month. The movement of Bitcoin into and out of both funds can be seen in the following chart.

Institutions are Probably Waiting on the Sidelines

To note is that the beginning of reduced institutional interest related to Grayscale’s and 3iQ’s Bitcoin trusts coincided with Bitcoin breaking the $28k to $30k price ceiling in early January. Bitcoin would go on to post an all-time high of $64,854 in mid-April.

Therefore, a loose conclusion can be reached that institutions were aware that Bitcoin had gone parabolic and that an entry into both the GBTC and QBTC, would have to wait for a pullback.

Bitcoin Attempts to Reclaim $38k

At the time of writing, Bitcoin is trading at $37,400 as it attempts to reclaim $38k as support.

Consequently, there is a fierce battle between Bitcoin bulls and bears due to the following two events.

Firstly, El Salvador has become the first country to acknowledge Bitcoin as legal tender and has just dug a geothermal well to power clean BTC mining. Secondly, a death cross still looms on the Bitcoin daily chart. As a result of, there is an equal probability of Bitcoin pumping above $38k and falling back to $30k or lower.