In brief:

- Chainlink just posted a new all-time high of $32.10 – Binance rate

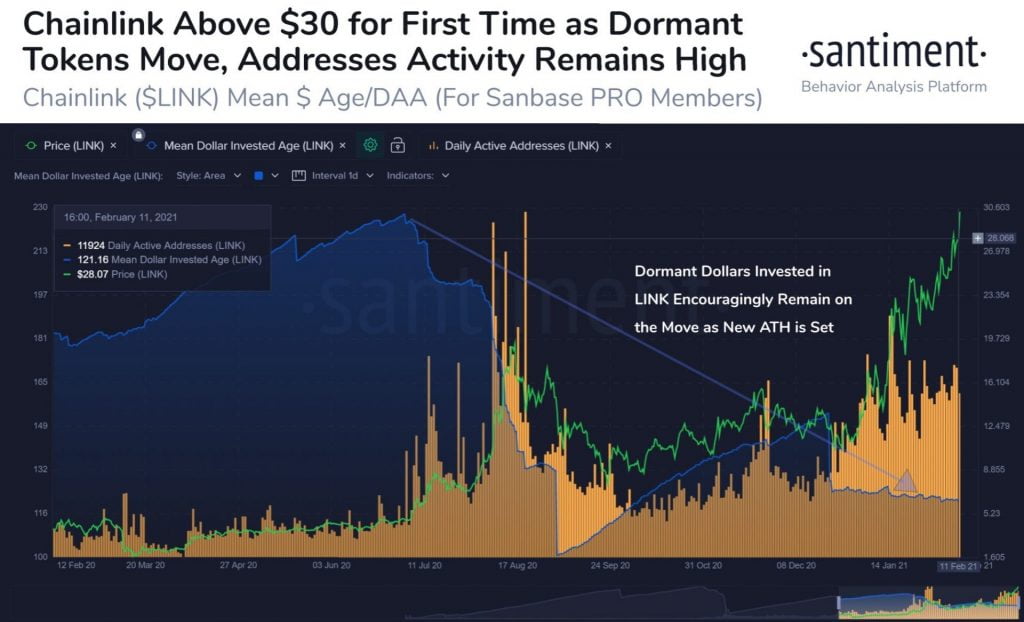

- LINK’s impressive market performance is backed by a high level of tokens circulating and a sustained high unique address activity

- Chainlink could very well continue on its upward trajectory towards higher levels

- However, its fate is tied to that of Bitcoin and a correction by BTC could halt LINK’s bullishness

The digital asset of Chainlink (LINK) has just set a new all-time high of $32.10 – Binance rate. Chainlink’s impressive performance is backed by an increment in token circulation as well as a high LINK address activity. This is according to data shared by the team at Santiment that also pointed out that Chainlink’s high unique address activity has been sustained since the year began.

The team at Santiment shared their analysis of Chainlink through the following statement and accompanying chart demonstrating the correlation between Chainlink’s address activity and the price of LINK.

$LINK hit a new #ALLTIMEHIGH today… backed by a continued increased level of token circulation, dormant tokens moving, and a sustained high level of unique address activity. These primary metrics are key to a continued #Chainlink price push!

What the Chainlink Daily Chart Says

With respect to the short-term future of Chainlink, the digital asset is attempting to turn the $30 price area into a support zone. At the time of writing, Chainlink is trading at $29.90 amidst a general crypto-wide pullback that has seen Bitcoin lose the crucial $48k support.

Chainlink (LINK) is very much in bullish territory as shall be elaborated using the daily LINK/USDT chart below.

To begin with, trade volume is in the green, with Chainlink’s value very much above the three crucial moving averages: 50, 100 and 200 day MAs. Secondly, the daily MACD is also hinting at a continuation of Chainlink’s bullishness. However, the daily MFI and RSI are pointing towards an overbought scenario at values of 83 and 78 respectively.

Therefore, and as with the case with most altcoins such as Chainlink, a continuation of its bullish trajectory is very much reliant on a stable and/or bullish Bitcoin. If the King of Crypto can maintain a value above $46k or even $45k, Bitcoin would provide a good environment for Chainlink to keep pushing higher in the hours and days to follow.

The converse is also true, if Bitcoin were to have a red weekend, Chainlink could very well experience its own correction that could see LINK drop below $30 to support zones found at $28.7, $27 and $26.20.