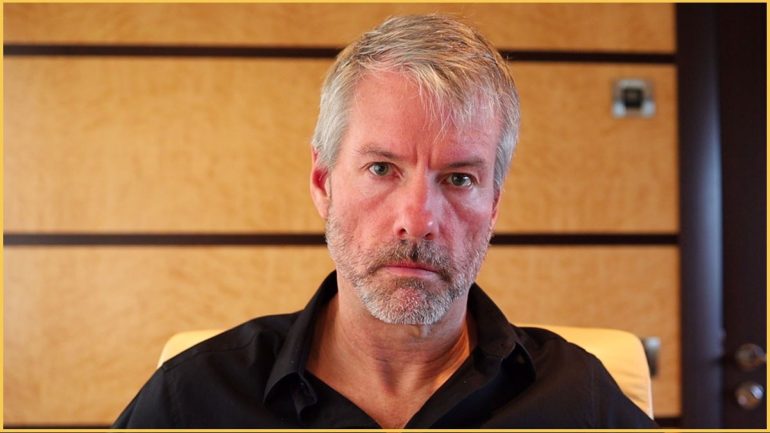

- Michael Saylor’s Microstrategy has announced yet another huge Bitcoin buy

- The company’s subsidiary splurged a massive $190.5 million to purchase some 4,167 BTC

- Saylor’s latest acquisition puts the firm’s total BTC holdings at around $6 billion

- Also, the news comes days after MicroStrategy secured a hefty loan from Silvergate Bank

According to an update on the official MicroStrategy website, the Virginia-based analytics and business intelligence behemoth deployed approximately $190.5 million towards buying more BTC.

The firm reportedly acquired an additional 4,167 BTC to add to its significant crypto vault. CEO and co-founder Michael Saylor confirmed the news via Twitter on Tuesday. Saylor’s tweet reads:

MacroStrategy has purchased an additional 4,167 bitcoins for ~$190.5 million at an average price of ~$45,714 per #bitcoin. As of 4/4/22 MicroStrategy #hodls, ~129,218 bitcoins acquired for ~$3.97 billion at an average price of ~$30,700 per bitcoin

Indeed, MicroStrategy facilitated the purchase through its subsidiary MacroStrategy. The affiliate company recently signed a loan agreement worth $205 million with San Diego-based Silvergate Bank. Following the bumper loan announcement, Saylor said the firm planned to buy even more BTC.

As of the time of writing this report, the company’s total BTC bag is valued at a staggering $5,936,533,356. Also, MicroStrategy remains the single largest publicly known BTC holder.

Institutions Bet Big on Bitcoin

MicroStrategy has stocked up on the world’s leading cryptocurrency since August 2020. Regardless of significant market dips in May 2021 and December 2021, Saylor has stressed that the company has no plans to sell its BTC holdings.

Elon Musk’s electric automobile giant Telsa also has crypto on its balance sheet. The carmaker supposedly owns some 43,0000 Bitcoins. Mike Novogratz’s Galaxy Digital holds a significant amount of BTC as well.