In brief:

- Ripple CEO, Brad Garlinghouse, has requested US regulators to step up and lean into digital assets.

- The current complacency by US regulators concerning digital assets will set back the United States as China leads the way in embracing crypto and digital fiat payments.

- Users of XRP want to work with regulators.

The CEO of Ripple, Brad Garlinghouse, has requested U.S regulators to step up and lean into digital assets or risk playing a game of catch up with China. The latter country has continued to lead the charge in shaping the crypto and digital fiat industry within its borders.

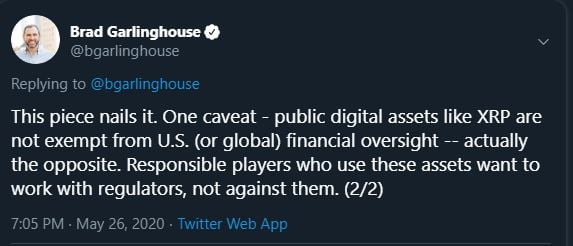

Mr. Garlinghouse made the comments in a two-part Twitter thread. He was responding to an article that postulated on the possibility of a digital Yuan unseating the U.S dollar in the global financial system. Brad Garlinghouse requested U.S regulators via the following statement on the social media platform.

U.S. regulators: now is the time to step up and lean into digital currencies. Remaining complacent is actually setting us back, while China’s grip on both crypto and fiat payments becomes stronger.

Major Players in the Digital Asset Industry Want to Work with U.S Regulators

He further explained that responsible players who use digital assets such as XRP, actually want to work with U.S regulators. A screenshot of the second installment of his comments can be found below.

China’s Grip on Crypto and Fiat Payments Continues

Mr. Garlinghouse was responding to an article that postulated that China’s digital Yaun had the potential to unseat the United States Dollar as the preferred global fiat currency. The digital Yuan would eventually allow China to expand its influence across the globe and additionally reinforce its economic agendas in Africa, the Middle East, and Southeast Asia.

Therefore, such a move by China needed to be countered by an equal or more elaborate one from the United States in digitizing its dollar. Failure to do so would result in the latter superpower, losing control of the dollar-dominated financial system. Countries with sanctions such as Iran, Venezuela, and North Korea, would have an efficient way of bypassing them through the digital Yuan. More on this can be found in the article available here.

(Feature image courtesy of Pixabay.)