- Coin Metrics report shows a marked increase in stablecoin hodlers.

- All stablecoins have grown in usage number, including those not pegged to the U.S. dollar.

- Stablecoins will be a large part of regulatory focus this year.

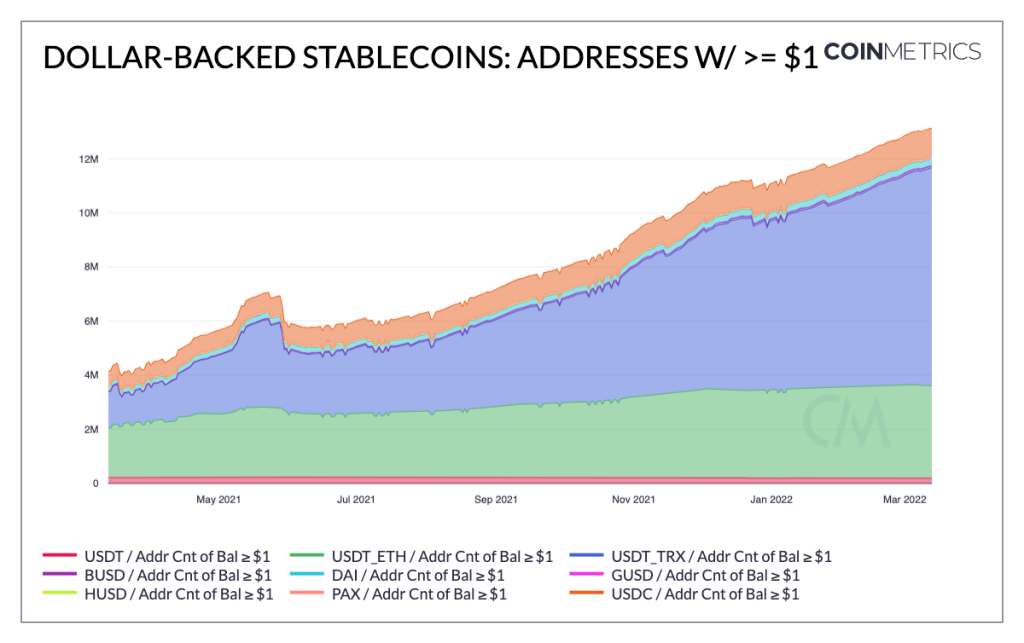

Stablecoins appear to be gaining momentum as usage numbers of the fiat-pegged assets are growing noticeably, as measured by a number of metrics. Coin Metrics’ State of the Network report noted that the total number of addresses holding at least $1 worth of stablecoins recently surpassed 12 million.

This figure is three times what it was a year ago, which is a remarkable increase by any measure. In the first quarter of 2021, the number of dollar-backed stablecoins was under 4 million, with most of those assets being USDT on the Tron blockchain.

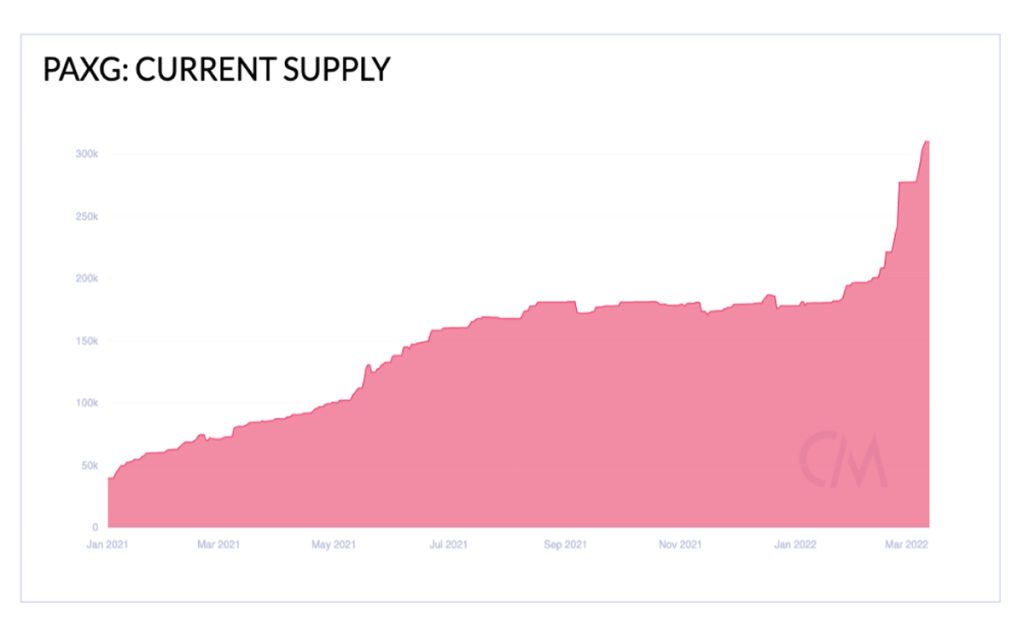

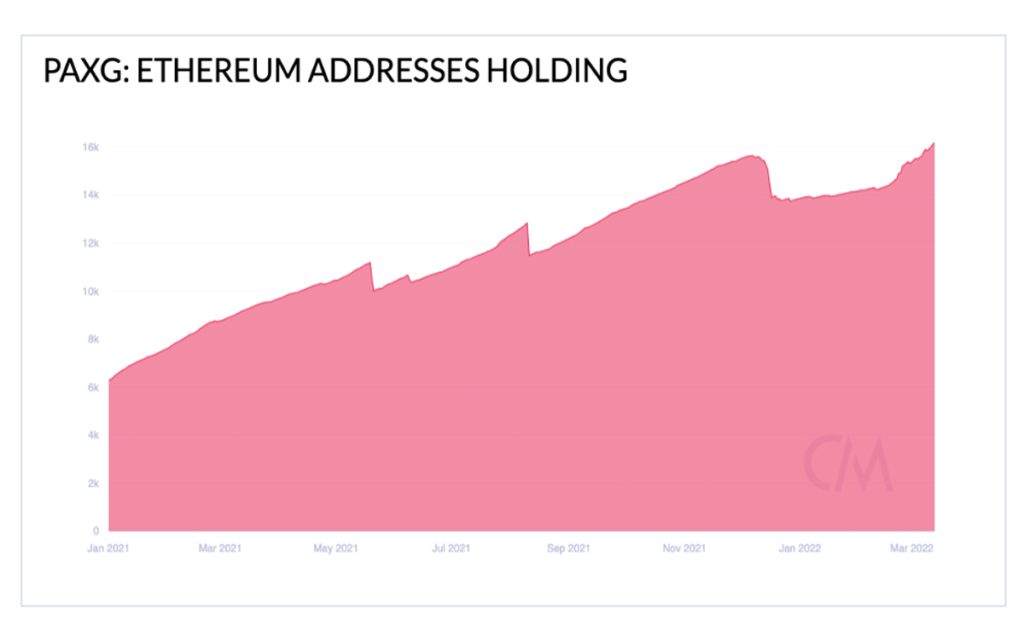

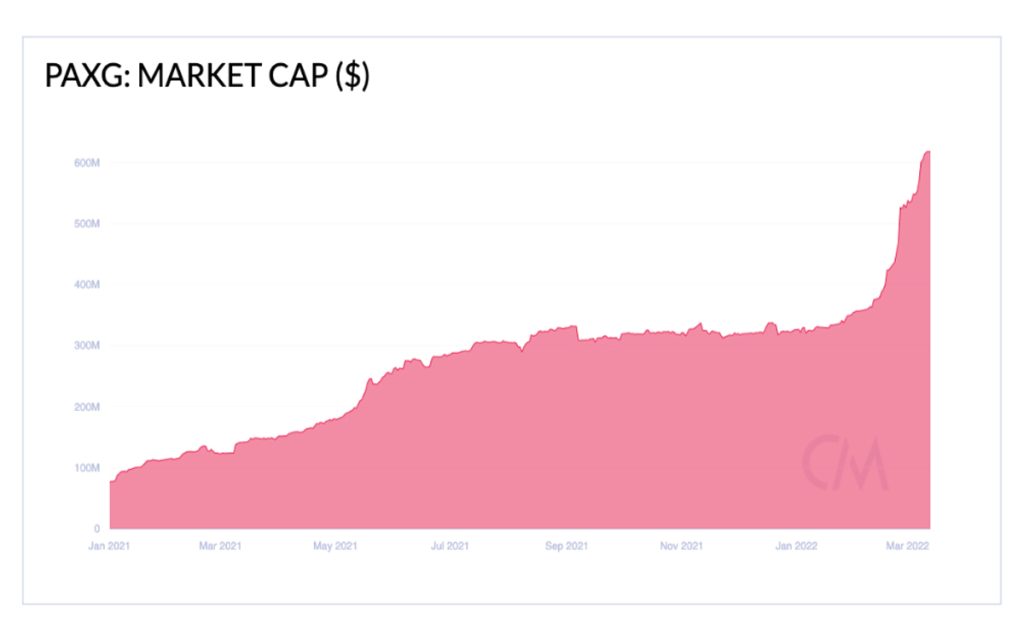

However, nearly all stablecoins on different blockchains have been experiencing good growth. This includes stablecoins that are not pegged to the U.S. dollar. Gold-backed stablecoins like PAX Gold and Tether Gold have also been growing. Approximately 775 gold bars are now represented by PAX Gold.

Stablecoins are often utilized to combat the market’s volatility, as they keep their prices stable as other assets rise and fall. This allows traders to purchase more of a volatile asset when the market is in a downtrend, provided they can time it right.

The rise of tokenized assets like currencies and gold points towards a shift in the nature of investments. This can sometimes draw the ire of regulators, as in the case of the United States Securities and Exchange Commission (SEC) and synthetic asset projects like Mirror Protocol.

Growth of Stablecoins, Likely to Be Accompanied by Heavy Regulation

Stablecoins have emerged as one of the biggest concerns for lawmakers, who are dealing with crypto regulations on many fronts. There have been conflicting reports on the degree to which stablecoins will be regulated, though regulation is certainly inevitable. The Fed Chairman has said that stablecoins could coexist with Central Bank Digital Currencies (CBDCs), which is a positive takeaway.

Governments are also concerned about the potential cross-border ramifications of fiat-pegged assets. The United States in particular is working on related regulation, and Treasury Secretary Janet Yellen has made remarks relating to the same, saying that the U.S. would work with international parties to prevent risks.

What’s clear is that stablecoins are here to stay and that lawmakers will have to come up with some framework to ensure they remain compliant. 2022 is shaping up to be a year of regulation, so it won’t be long before something is announced. And with Joe Biden’s recent executive order, it looks like the United States will be paving the way.