Summary:

- 30,000 BTC has flowed out of the Coinbase crypto exchange

- This amount could be a sign that institutional investors are once again interested in Bitcoin

- President Biden’s executive order on digital assets could be a reason for the renewed interest as it did not create any significant hurdles for Bitcoin investors

- The United States ranks third among crypto-friendly countries

30,000 Bitcoin has flowed out of the Coinbase crypto exchange in the last 24 hours.

This event was captured and highlighted by the CEO of CryptoQuant, Ki Young Ju, who also floated the theory that the movement of 30k Bitcoin could be the result of institutional buying as a result of President Biden’s executive order outlining the government’s approach to digital assets.

According to Mr. Ju, the executive order ‘did not create any hurdle’ for the stated institutional investors.

30k $BTC flowed out from Coinbase today.

Institutional buys might be the big narrative again because the Executive Order did not create any hurdle.

h/t @burak_tamac

Live Chart 👇https://t.co/3ZifmxFo1j pic.twitter.com/KjA7OpefMd

— Ki Young Ju 주기영 (@ki_young_ju) April 15, 2022

$40k Per Bitcoin Sounds Cheap for Whales

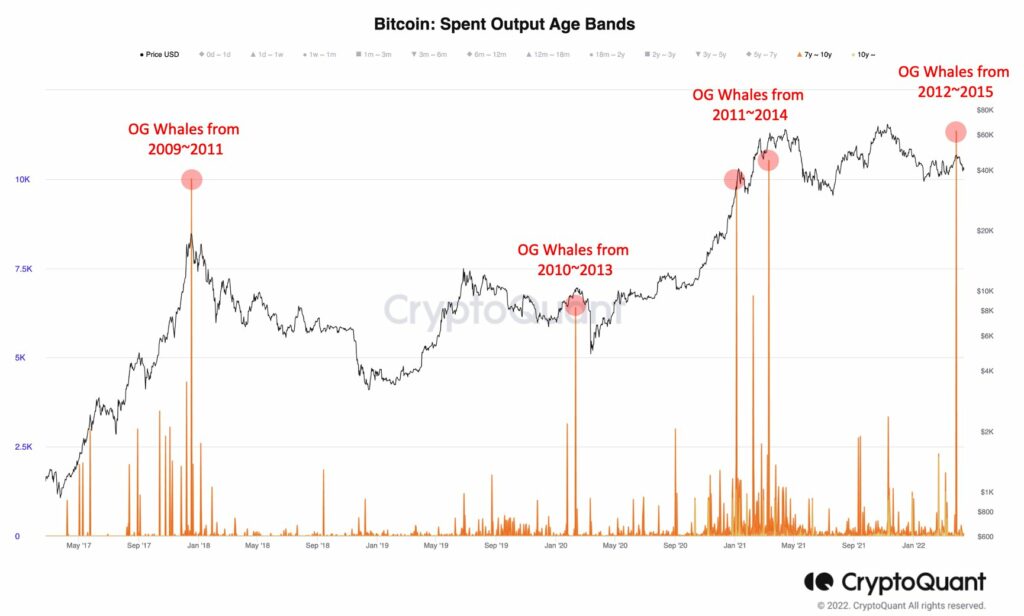

In another analysis shared on Twitter, Mr. Ju speculated that Bitcoin whales sold part of their holdings when BTC hit $47k. The same whales are now accumulating at $40k as the price of Bitcoin seems cheap. He further shared the following chart demonstrating the selling behavior of whales over the years and at different price areas.

The United States Ranks Third Among Crypto-Friendly Countries

Circling back to why institutional investors might be warming up to Bitcoin, the United States is now ranked third among crypto-friendly countries. This is partly due to President Biden and his administration seeking for better understanding and regulation of the crypto sector. The aforementioned executive order by President Biden calls for measures addressing the following regarding digital assets.

- Protection of US customers, investors, and businesses

- Protection of the US and global financial stability and mitigation of systemic risk

- The mitigation of illicit finance and national security risks posed by the illegal use of digital assets

- Promotion of US leadership in technology and economic competitiveness to reinforce US leadership in the global financial system

- Promotion of equitable access to safe and affordable financial services

- Supporting technology advances and ensuring responsible development and use of digital assets

- Exploration of a US Central Bank Digital Currency

Additionally, according to a report by Blockworks, the United States is now ranked first in mining as the country now controls 35% of the total Bitcoin hash rate ahead of Kazakhastan.