Bitcoin Dominance Continues to Bound Higher

As detailed by Ethereum World News on multiple occasions, altcoins haven’t been doing too hot against Bitcoin (BTC) as of late. In fact, ever since Bitcoin began its surge off its $3,150 lows in December, it has managed to outpace Ethereum, XRP, and so on and so forth.

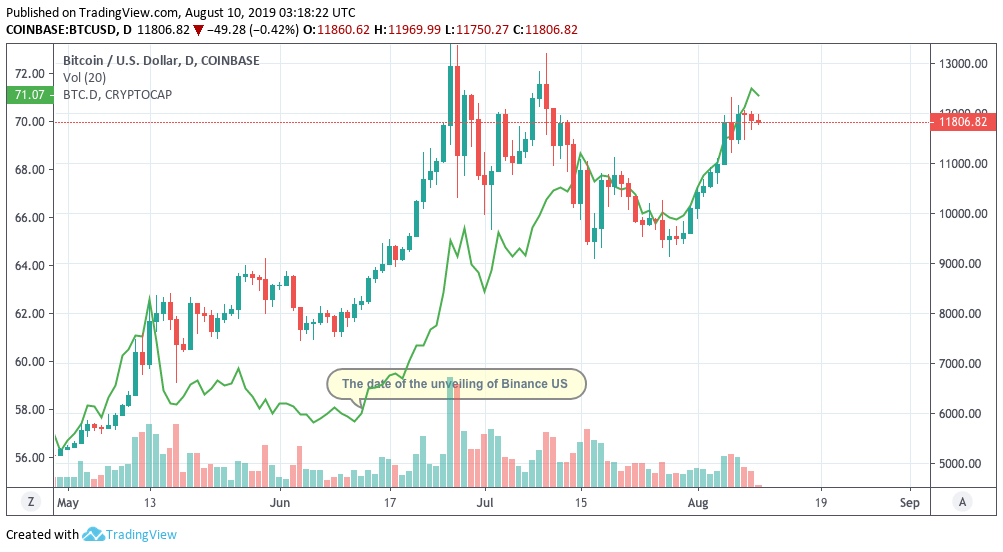

This trend has allowed Bitcoin dominance to set a two-year high, which is quite astonishing, especially considering the technical developments and fundamental changes that altcoins and non-Bitcoin blockchain technologies have seen over the past 24 hours.

Many have attributed this trend to simple market cycles. As we wrote earlier this month, Chris Burniske a partner at venture fund Placeholder, suggested in a Twitter thread that when BTC rallies strongly, a “majority of ‘alts’ fall against Bitcoin.”

Burniske attributes this to the fact that Bitcoin is the main liquidity provider in the space, thus making it illogical to sell much of the time. He added that large investors, which he calls “whales”, eventually move into altcoins that have lost traction against BTC. This results in an “alt-season”, whereas certain altcoins experience more gains than the market leader itself.

Another popular theory is the fact that altcoins have simply failed to deliver what they promised to investors. Back in 2017, countless projects were telling their prospective investors that they could offer thousands of transactions a second, decentralization, zero fees, and other benefits that even blockchains like Bitcoin and Ethereum cannot offer.

However, there may be another way to explain this trend. When analyst Cantering Clark posted the tweet below, that got me thinking.

He writes that Bitcoin’s recent outperformance of the broader asset class likely has much to do with Binance’s decision to temporarily withdraw from the U.S. market due to regulatory concerns. This means a likely large loss of liquidity and investment interest for some altcoin markets, making it logical for American users of the exchange to dump altcoins that source a majority of their market activity from Binance and American traders.

If you look at the Bitcoin dominance chart for the date of June 14th, which is when Binance revealed that it would be jumping the U.S. ship, there began a clear acceleration in the Bitcoin dominance’s foray to the upside. Just look at the image below. This could imply that to front-run the dump of altcoins, investors began to liquidate their non-Bitcoin crypto assets on the date that Binance US was unveiled.

Altcoins Falling Out of Favor

Even if Bitcoin’s outperformance has nothing to do with market cycles or Binance’s foray into the United States, altcoins are simply falling out of favor with the crypto trading audience.

Prominent industry investor and commentator Su Zhu wrote the below tweet, explaining that he believes that under 25 current altcoins will ever hit their all-time high against the U.S. dollar or Bitcoin.