- Chainlink technology was integrated into 55 projects in the month of May

- Chainlink is currently integrated into a total of 567 projects globally

- The Chainlink project recently celebrated its second mainnet launch anniversary

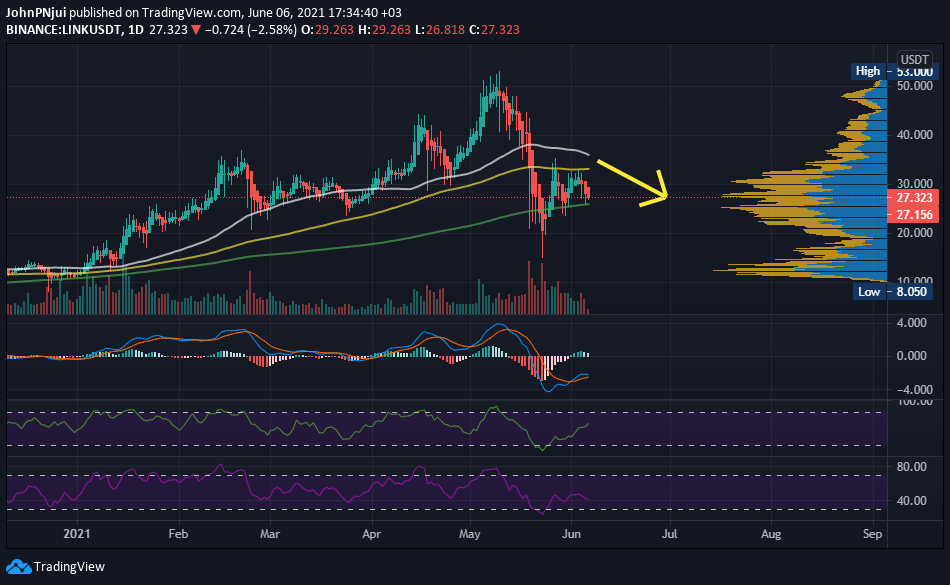

- The 200-day MA is providing adequate support for Chainlink

- However, a death cross is on the horizon for Chainlink that could cause a retest of $15

Chainlink oracles and price feeds were successfully integrated into 55 projects in the month of May. At the time of writing, Chainlink’s ground-breaking technology has been integrated into a total of 567 projects globally with the number growing on a daily basis.

Chainlink Celebrates 2-Year Mainnet Anniversary

Also in the month of May, Chainlink celebrated its two-year mainnet anniversary during which the project’s founder, Nazarov, thanked the community for its consistent and continuous support.

Chainlink’s 200-day MA Continues To Hold as Support

With respect to price action, the month of May was an eventful one for Chainlink.

To begin with, LINK set an all-time high of $53 on May 10th. However, this achievement was short-lived as the crypto markets were rocked by a selloff catalyzed by speculation of Tesla selling its Bitcoin holdings and China reiterating its 2018 ban on BTC mining and crypto trading.

Consequently, Chainlink started what would be a two-week pullback, worth 71.7%, that would see LINK hit a local low of $15 on the 23rd of May. The price of LINK soon rebounded to the $28 price level and is currently trading at $27.162 and slightly above the 200-day moving average. This important moving average can be seen (green) in the following daily LINK/USDT.

A Death Cross Looms for Chainlink (LINK)

Also from the chart, it can be observed that the 50-day moving average (white) is on a path towards intersecting with the 200-day moving average in the next few weeks. Such an event would be the dreaded death cross that usually confirms a bear market for any asset.

In the case of Chainlink, several indicators point towards a possible retest of the $15 price area in the weeks to follow.

To begin with, and from the chart, the daily trade volume has been decreasing with the daily MACD highlighting a slowdown in buying of LINK. The MFI is also on a path towards entering overbought territory and the RSI confirms the reducing buying of Chainlink in the crypto markets.

In summary, Chainlink has a high probability of dropping back down to the ‘teen’ levels towards the end of June.

However, such an event can be negated by Bitcoin breaking past the $40k resistance and forging a path towards $50k. But Bitcoin is also facing a death cross of its own that would accelerate a drop by Chainlink in the second half of June.