Summary:

- Jump Crypto has released a report reviewing the collapse of UST.

- According to their analysis, UST’s depeg was triggered by a sequence of trades in the UST/3CRV Curve pool.

- UST outflows from Anchor Protocol soon followed, further straining the stablecoin’s stability.

- The strong market sell-off that followed accelerated the depegging of UST in the crypto markets.

Jump Crypto, an early investor in the Terra (LUNA) project, has released a comprehensive report on the events surrounding the depegging of TerraUSD (UST) in May.

According to their analysis, the research team at Jump Crypto came to the following three conclusions regarding the events that happened between May 7th and May 9th.

- USTs depegging was triggered by a sequence of trades in the UST/3CRV Vurve pool beginning May 7th.

- Subsequent outflows on the Anchor Protocol between May 7th and May 9th from large traders added pressure to UST’s peg.

- The crypto market sell-off that followed on Monday, May 9th, further accelerated the depeg of UST due to additional sell pressure.

UST’s Depeg Originated in the Curve Pools

To begin with, the report by the research team at Jump Crypto took an in-depth look at the sequence of trades on Curve Finance that started it all. On May 7th, liquidity conditions on Curve gradually worsened, and in a seventy-five-minute span, a series of quick transactions hit UST’s peg hard.

- Terraform Labs (TFL) withdrew $150 million in UST liquidity. This made the Curve pool relatively balanced but much smaller.

- An inactive account, Wallet A, swapped $85 million UST for USDC in this pool, pushing the Curve pool out of balance again.

- Another account, Wallet B, swapped $75 million UST in the pool across three transactions as the pool imbalance continued.

- Terraform Labs withdrew another $100 million in UST liquidity, returning some level of balance, but the pool was still heavily imbalanced and vulnerable to the smallest of transactions.

- Wallet B swapped another $25 million UST in the pool.

- After 23:00, there was a flurry of activity in the Curve pool that was also captured by a recent report by Nansen.

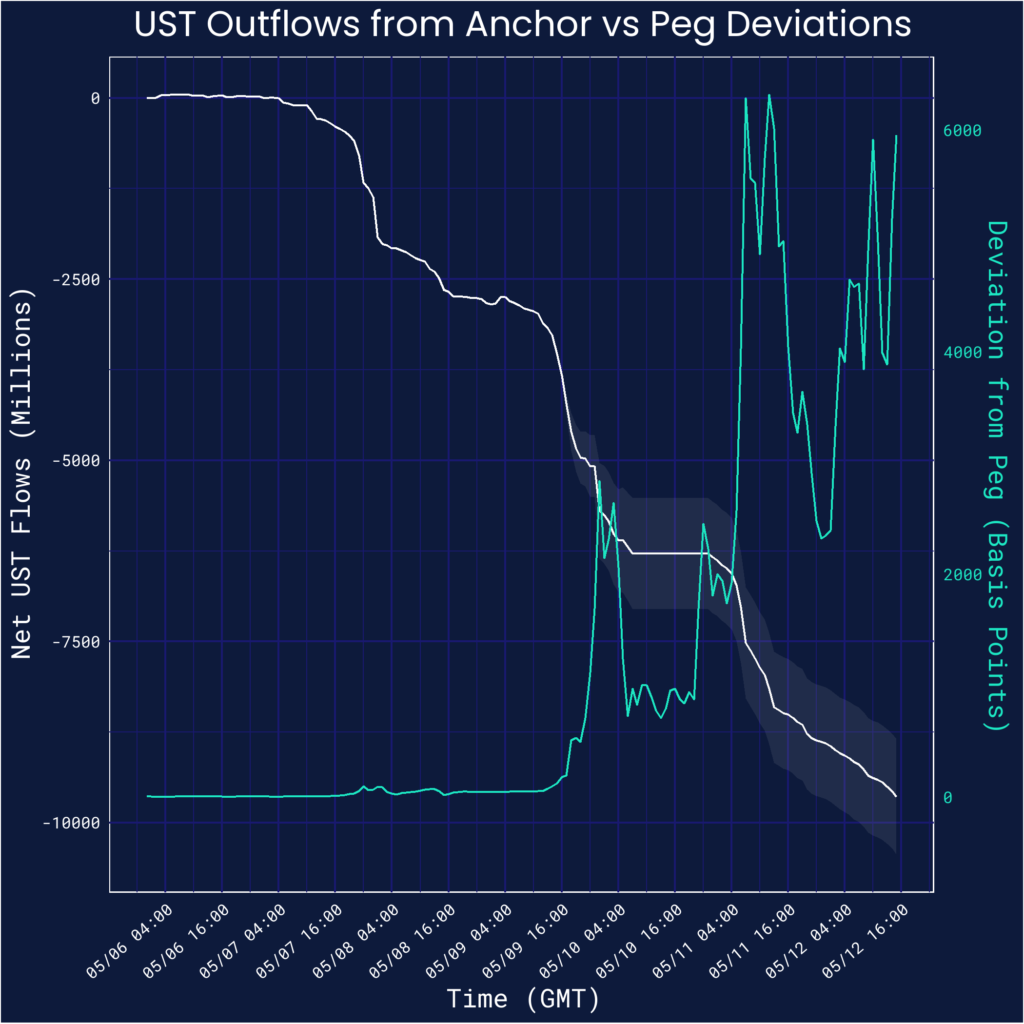

Subsequent Outflows from the Anchor Protocol

On May 7th, there were significant outflows from Anchor Protocol depositors, putting pressure on the peg of UST, as visualized in the chart below, courtesy of the report.

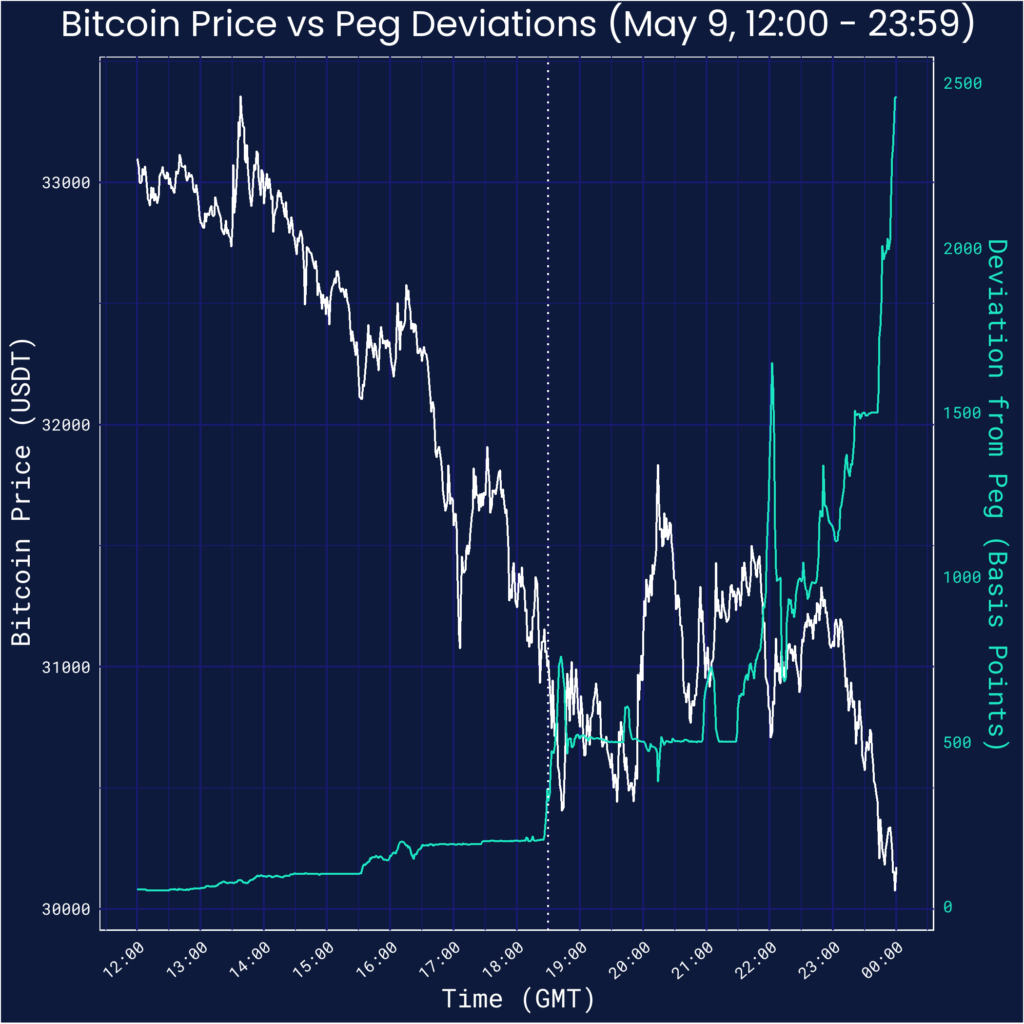

The Crypto Market Sell-off Accelerated UST’s Depeg

The final nail to UST’s collapse came from the massive Bitcoin and crypto market sell-off that followed on Monday, May 9th. The report further explains how the macroeconomic mood provided the perfect storm for UST. It said:

Outside of the pressure on the Terra ecosystem, there was high volatility in markets during this episode. Macroeconomic concerns relating to inflation, slowing Chinese growth, geopolitical turmoil, and other factors manifested in a continuous selloff in crypto markets.

At a high level, this coincided with the deviation of the UST peg…the evening (GMT) of May 9 looks particularly critical, as BTC fell sharply just as UST came off the peg meaningfully.