Quick take:

- Approximately $10 Billion worth of digital assets is committed to staking.

- Investors prefer to stake Tezos (XTZ), EOS, and Algorand (ALGO).

- A total of $4.4 Billion is staked via the three digital assets.

Staking digital assets has become common with investors who would rather sit out the crypto market volatility and watch their holdings multiply over time. As a result, many crypto exchanges have been quick to support the feature to attract crypto users to store/lock their digital assets on their platforms. They include exchanges such as Bitfinex, Binance, OKEx, Poloniex, KuCoin, Coinbase, and more.

Investors Prefer to Stake Tezos (XTZ), EOS and Algorand (ALGO)

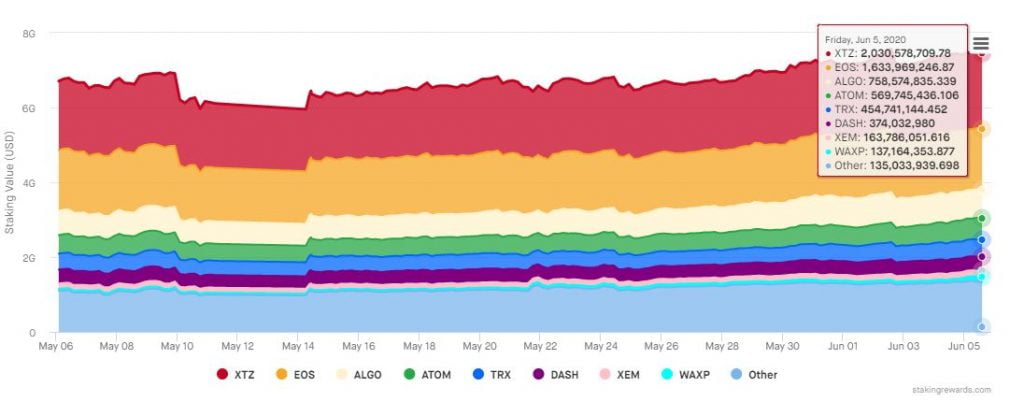

It is with this brief background that the team at StakingRewards.com has analyzed the digital assets locked up in staking and concluded that Tezos (XTZ), EOS and Algorand (ALGO) are the most staked digital assets. Below is a chart from StakingRewards.com that provides a better visual cue of the top digital assets staked by crypto investors.

From the chart, it is observed that investors also prefer to stake ATOM, Tron (TRX), DASH, Nem (XEM) and Wax (WAXP).

$10 Billion Locked Up in Staking

Furthermore, another chart on StakingRewards.com reveals that the total amount of digital assets staked is worth $10 Billion. This value represents 3.57% of the total crypto market cap of $280 Billion at the time of writing this. The chart below provides additional analysis in this regard.

Why Staking is a Safer Option to Trading Crypto

In conclusion, crypto investors have found staking as a safer bet than risking their capital trading crypto or futures contracts amidst the market volatility. One look at the Binance staking page reveals why the idea of locking up digital assets is so appealing. Below is a list of digital assets available for staking on Binance and their corresponding annual yields.

- Tezos (XTZ): 6 – 7% pa

- EOS: 1 – 3% pa

- Algorand (ALGO): 8 – 10% pa

- Tron (TRX): 7 – 9% pa

- TOMO: 1 – 5% pa

- ARK: 1- 3% pa

- ARPA – 1 – 10% pa

- LISK: 1 – 2% pa

- THETA: 1 – 2% pa

- LOOM: 10 – 12% pa

- Kava (KAVA): 14 – 16% pa

- ATOM: 6 – 9% pa

- Harmony (ONE): 6 – 9% pa

- Fetch (FET): 8 – 12% pa

- Stratis (STRAT): 1 – 2% pa

- QTUM: 6 – 8% pa

- Komodo (KMD): 5 – 6% pa

- VeChain (VET): 3 – 5% pa

- Ontology (ONT): 3 – 5% pa

- NEO: 1 – 3% pa

- TROY: 15 – 16% pa

- Elrond (ERD): 3 – 4% pa

- Stellar (XLM): 2 – 4% pa