In brief:

- Bitcoin (BTC) is currently trading at $7,780; Ethereum (ETH) at $194; and XRP at $0.20.

- The Stock market has had its worst day since the 2008 Financial Crisis due to the effects of the Coronavirus on the Global Economy.

- Oil prices have dropped by over 30% with the price per barrel hovering above $30.

- US markets halted trading after the S&P 500 dropped by 7%.

- Even with the Bitcoin halving in approximately 2 months, doubts linger that BTC will continue with the narrative that it is a safe haven during times of extreme stock market turmoil.

Less than 24 hours ago, Ethereum World News had predicted that a Coronavirus induced recession would be the biggest test Bitcoin (BTC) will face since its first block was mined in January of 2009. Further analyzing the global economic atmosphere of today as a result of the spread of the Coronavirus, we find that the Dow has dropped by close to $2,000, the S&P 500 has dropped by over $200 and Oil prices per barrel have dropped by over 30%. As a result, trading on the major US stock exchanges was halted for 15 minutes due to the rapid rate of decline of the S&P 500.

Bitcoin, Ethereum, XRP and All Crypto in The Red

Consequently, Bitcoin has dropped below the $8,000 dollar mark and is currently trading at $7,780 at the time of writing this. Ethereum is trading below $200 at a value of $194 with XRP finding some support at $0.20. Majority of the top 100 cryptocurrencies according to Coinmarketcap, have lost between 5% and 15% of their worth in the last 24 hours. The total crypto market capitalization currently stands at $221 Billion which is $40 Billion lower than levels witnessed on Saturday, March 7th.

It Might Get Worse for Bitcoin, Ethereum and XRP

Despite the upcoming Bitcoin halving event being bullish for BTC and the entire cryptocurrency industry, the current global economic environment is such that investors might decide to avoid risk assets completely. Further studying the historical performance of digital cryptocurrencies, we find that they fit into the category of risk assets based on their over-the-top volatility as witnessed with today’s market action. This, in turn, means that things might get worse before they get better for Bitcoin, Ethereum, XRP and the entire crypto market.

However, when we reread the abstract of the Bitcoin whitepaper by Satoshi Nakamoto, we realize that BTC was particularly made to bypass financial institutions that are at the core of the stock market meltdown we are witnessing right now. The ongoing market turmoil will be the ultimate test for BTC and the entire crypto markets. In the coming days and weeks, we will find out whether the King of Crypto will rise to the occasion and offer a safe haven away from stocks and fiat currencies.

Positive News About the Coronavirus Might Turn the Tide

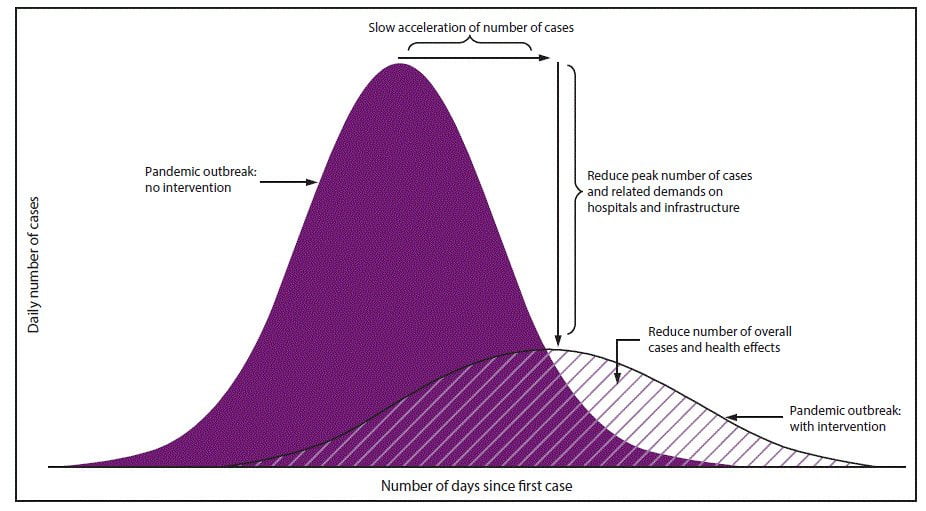

The increment of new cases of infections during a pandemic is known to follow a traditional Bell curve. At the time of writing this, global cases are increasing exponentially with countries such as China experiencing lower rates of new infections. We are currently on the left side of the bell curve below with global cases increasing in countries such as Italy, Canada, South Africa, the United States and more.

Signs of finally defeating COV19 will begin to emerge when the number of new cases start to plateau or enter the right side of the bell curve. With such news, both the stock and crypto markets will probably start to recover as the fear associated with the pandemic starts to reduce in favor of positive news indicating a win over the virus. In the latter case, the major cryptocurrencies of Bitcoin, Ethereum and XRP will finally find some support price levels thus initiating a trend reversal.

(Image courtesy of Unsplash.com)