Quick take:

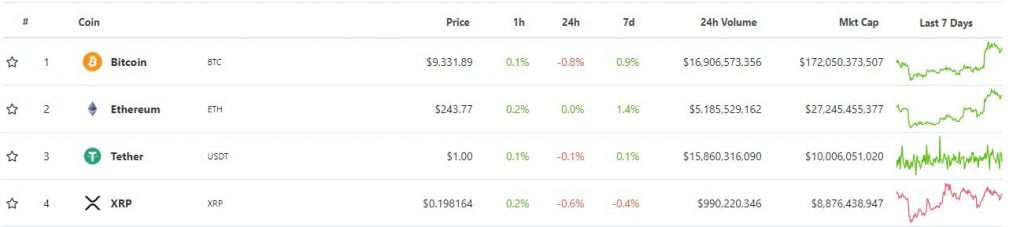

- Tether’s (USDT) market capitalization has just hit $10 Billion.

- USDT has cemented its number 3 spot in terms of market cap.

- Tether’s daily transaction volume is slowing catching up to that of Bitcoin and could soon eclipse it.

As the crypto-verse sets its eyes on Bitcoin’s price action, Tether (USDT) is slowly achieving milestones in terms of market capitalization and the value of its daily transactions. A quick look at CoinGecko reveals that Tether’s (USDT) market capitalization has hit the $10 Billion mark. Furthermore, checking the 24-hour volume of USDT compared to that of Bitcoin, reveals that approximately $1.1 Billion in trade volume separates the two assets.

Therefore, it can be loosely concluded that it is only a matter of time before Tether’s daily trade volume eclipses that of Bitcoin.

Tether Cements its Place at the Number 3 Spot

Confirming the market cap via Tether’s balance sheet reveals that the parent company of USDT has $10.166 Billion in total assets. This figure continues to grow as the stablecoin continues to be issued on several blockchain networks. At the time of writing this, Tether (USDT) is available on Omni, Ethereum, Tron, EOS, Liquid and the Algorand network.

The continual issuance of Tether means that USDT has cemented its place at the number 3 spot in terms of market capitalization. Therefore, XRP needs to trade above $0.22 to reclaim the spot. Also to note, is that the rate at which Tether’s market cap is increasing could result in USDT edging out Ethereum from the number 2 spot in the near future.

Tether’s Daily Transaction Volume Could Soon Eclipse Bitcoin’s

Additionally, recent analysis reveals that the daily transaction volume of stablecoins, led by Tether, has eclipsed that of Bitcoin. This change in dominance can be seen in the chart in the Tweet below by the team at CoinMetrics.

Bitcoin's Daily Transaction Value has fallen below that of stablecoin's and could soon be less than Tether's writes @olgakharifhttps://t.co/awXhXOCsiH pic.twitter.com/kAO9xPybDX

— CoinMetrics.io (@coinmetrics) July 22, 2020

According to an April report by the team at OKEx, the increased popularity of Tether is as a result of China banning fiat on-ramps back in 2017. Chinese traders use USDT as a quick way to transfer value. They explained…

After China effectively banned fiat on-ramps for local crypto exchanges in 2017, Chinese traders have continued to be heavily involved in the crypto market by using USDT. Since 2017, Coindesk reports, the percentage of overall crypto trading against the yuan dropped severely, reportedly from 90 percent to 1 percent of trades…

Almost all of the additional issuance of USDT has had strong market demand behind it. Tether provides effective liquidity to crypto investors who do not have a direct fiat gateway.

Additionally, the DeFi boom in the crypto-verse has increased demand for Tether as investors lend out, and borrow USDT on the various platforms.